The Federal Reserve needs to be transparent about its plans for monetary policy, but it should also be mindful of the impact that its actions can have on financial markets.

By repeatedly talking about the possibility of aggressive rate hikes, the Fed is sending mixed signals to the market. On the one hand, it is trying to signal its commitment to bringing inflation under control. On the other hand, it is creating uncertainty and volatility in financial markets.

This uncertainty is making it difficult for businesses to make investment decisions and for consumers to plan for the future. It is also leading to higher borrowing costs for businesses and consumers.

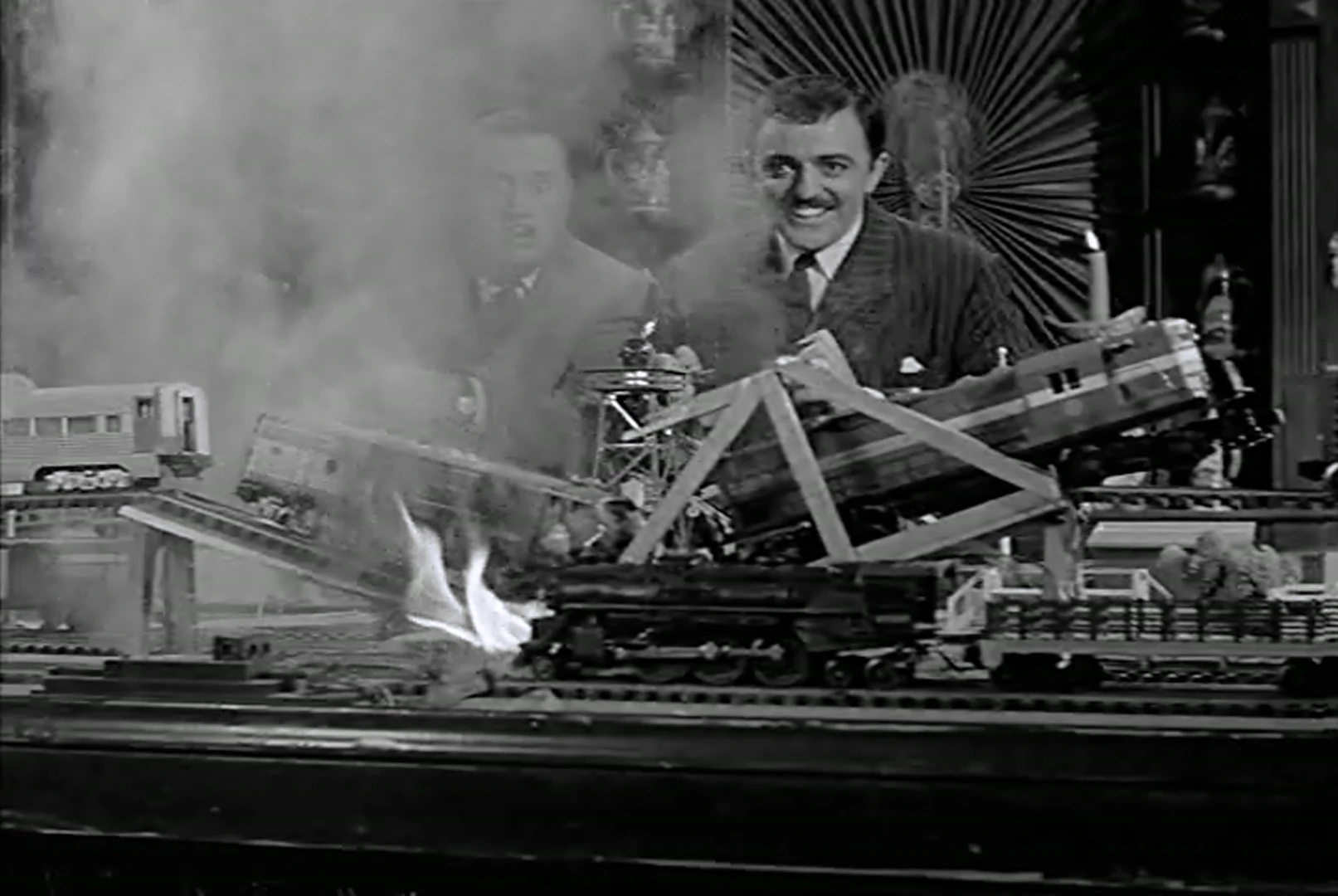

The Fed role is not to entertain the masses, they need far fewer press conferences and far more economic research”

Shayne Heffernan

The Fed needs to find a way to communicate its plans for monetary policy in a clear and concise way, without creating unnecessary uncertainty in financial markets. The Fed also needs to be mindful of the impact that its actions can have on the real economy. If the Fed raises interest rates too aggressively, it could risk tipping the economy into a recession.

The Fed is walking a tightrope. It needs to bring inflation under control, but it also needs to avoid causing a recession. The Fed needs to be careful not to taunt the market with rate hikes, but it also needs to be transparent about its plans for monetary policy.

Here are some specific suggestions for how the Fed can better manage the US economy:

- The Fed should provide more clarity about its plans for monetary policy. The Fed should explain how it is thinking about inflation and how it plans to bring inflation under control. The Fed should also provide more specific guidance about how many rate hikes it expects to implement and how high it expects interest rates to go.

- The Fed should be more mindful of the impact that its actions can have on financial markets. The Fed should avoid making sudden or unexpected changes to monetary policy. The Fed should also be transparent about the risks associated with its policy decisions.

- The Fed should work with Congress to develop a comprehensive plan to address inflation. The Fed cannot solve the inflation problem on its own. It needs the help of Congress to address structural problems in the economy that are contributing to inflation.

By following these suggestions, the Fed can better manage the US economy and avoid the pitfalls of taunting the market with rate hikes.

Shayne Heffernan