As the market experiences a sell-off, one stock that continues to stand out as a compelling opportunity is Tesla (TSLA). Despite recent volatility, Knightsbridge maintains a positive outlook on Tesla’s prospects and believes that the current price presents a buying opportunity for investors. With a price target of $500, Knightsbridge sees Tesla as an undervalued asset with significant growth potential.

Tesla, led by visionary CEO Elon Musk, has revolutionized the automotive industry with its innovative electric vehicles and renewable energy solutions. The company’s commitment to sustainability, coupled with its relentless focus on innovation and technology, has propelled it to the forefront of the electric vehicle market.

Despite facing challenges such as supply chain disruptions and increased competition, Tesla has demonstrated resilience and agility in navigating turbulent market conditions. The company’s strong brand loyalty, expanding product portfolio, and aggressive expansion into new markets position it for long-term success.

Moreover, Tesla’s recent financial performance has exceeded expectations, with strong revenue growth and improving profitability. The company’s robust delivery numbers, coupled with increasing demand for electric vehicles globally, bode well for its future earnings potential.

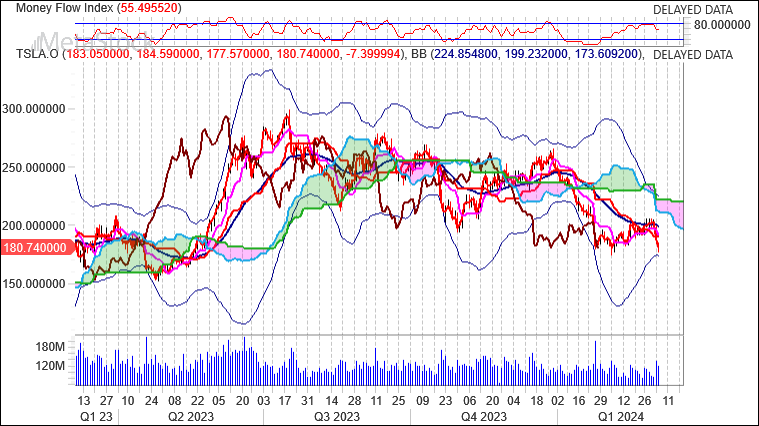

From a technical standpoint, Tesla’s stock price has recently experienced a pullback, presenting an attractive entry point for investors looking to capitalize on the company’s long-term growth prospects. With a solid track record of innovation and a leading position in the rapidly growing electric vehicle market, Tesla remains a top pick for investors seeking exposure to the future of transportation and sustainable energy.

Candlesticks

A black body occurred (because prices closed lower than they opened).

During the past 10 bars, there have been 5 white candles and 5 black candles. During the past 50 bars, there have been 23 white candles and 27 black candles for a net of 4 black candles.

A falling window occurred (where the bottom of the previous shadow is above the top of the current shadow). This usually implies a continuation of a bearish trend. There have been 5 falling windows in the last 50 candles–this makes the current falling window even more bearish.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 25.2948. This is not an overbought or oversold reading. The last signal was a sell 10 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 35.66. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 18 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is -216.This is an oversold reading. However, a signal isn’t generated until the indicator crosses above -100. The last signal was a sell 2 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 17 period(s) ago.

TESLA INC gapped down today (bearish) on normal volume. Possibility of a Runaway Gap which usually signifies a continuation of the trend. Four types of price gaps exist – Common, Breakaway, Runaway, and Exhaustion. Gaps acts as support/resistance.

TESLA INC is currently 23.1% below its 200-period moving average and is in an upward trend. Volatility is high as compared to the average volatility over the last 10 periods. Our volume indicators reflect moderate flows of volume into TSLA (mildly bullish). Our trend forecasting oscillators are currently bullish on TSLA and have had this outlook for the last 8 periods.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Knightsbridge maintains a bullish stance on Tesla, viewing the current sell-off as a temporary setback amidst a broader trend of sustained growth and innovation. With a price target of $500, Tesla represents a compelling investment opportunity for those with a long-term horizon and a belief in the transformative potential of electric vehicles and renewable energy.