Tesla’s shares surged after a Wall Street bank predicted that the electric car company’s value could rise above $1.2 trillion thanks to investments in an artificial intelligence (AI) supercomputer.

Morgan Stanley said that Tesla’s “Dojo” AI system, which is used to train driverless cars, could give the company a significant advantage over its rivals.

Elon Musk, Tesla’s CEO, has said that driverless software will make his cars significantly more valuable, although the arrival of fully autonomous Teslas has taken longer than he predicted.

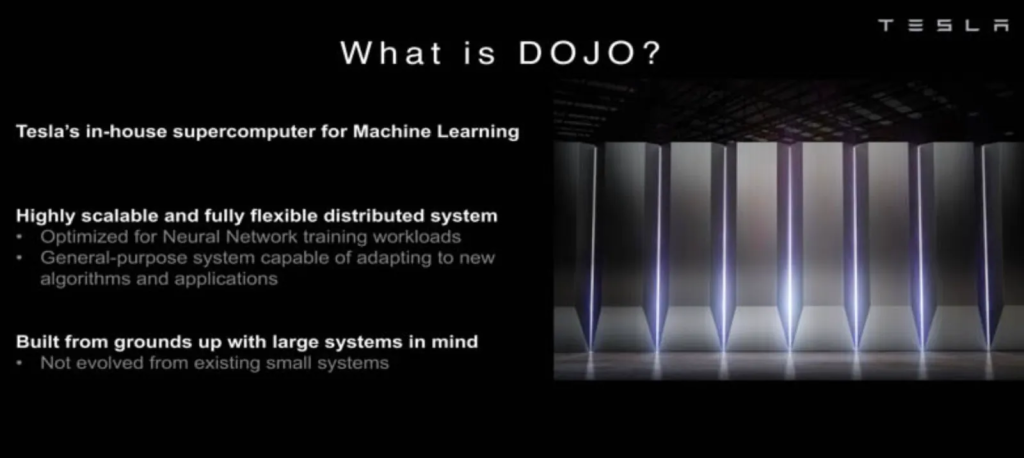

Tesla has said it expects to invest more than $1 billion in its Dojo supercomputer, a high-powered system using thousands of custom microchips that can process huge quantities of video footage collected by its cars.

A “beta” version of the company’s Full Self Driving system is available to Tesla owners in the US and Canada, but Musk has repeatedly predicted that the cars will soon be able to operate as fully fledged “robo-taxis”.

Morgan Stanley analysts said that revenues from this and licensing the technology to other carmakers could push Tesla’s share price from $248.50 to $400. This would raise its market value from $789 billion to $1.27 trillion. The bank said that under a “bull case” scenario, the company could be worth more than $1.7 trillion.

Tesla shares jumped by more than 9%, giving it a value of around $850 billion.

Musk has increasingly focused on AI as more car manufacturers, particularly in China, develop electric vehicles.

He has unveiled a robot named Optimus that he says will be able to do “anything that humans don’t want to do”.

Tesla’s autonomous technology has earned the company repeated scrutiny from regulators. A more basic version, Autopilot, is the subject of multiple investigations over concerns ranging from phantom braking to failing to stop around emergency vehicles.

However, many commentators have been impressed with improvements in the company’s Full Self Driving system, which is being tested by thousands of owners.

Tesla has turned to developing its own microchip for the Dojo system due to the high cost of in-demand processors made by Nvidia.

Morgan Stanley analysts wrote: “Investors have long debated whether Tesla is an auto company or a tech company. We believe it’s both, but see the biggest value driver from here being software and services revenue.”

Shayne Heffernan