- March headline CPI +2.83 y/y vs +3.30% in poll

- March core CPI +1.75% y/y vs +1.82% in poll

- Inflation seen below 2.5% in Q2 – ministry

- Cuts 2023 headline inflation forecast to 1.7-2.7% from 2-3%

Last week, the central bank raised its policy rate for a fifth straight meeting and said its policy tightening would continue since, while inflation was slowing, it remained higher than in the past.

The central bank has hiked the benchmark interest rate by a total of 125 basis points since August to 1.75% to contain price pressures.

The commerce ministry forecast headline inflation would fall further later this year, helped by lower oil prices, government support measures and a high base last year, senior ministry official Wichanun Niwatjinda told a news conference.

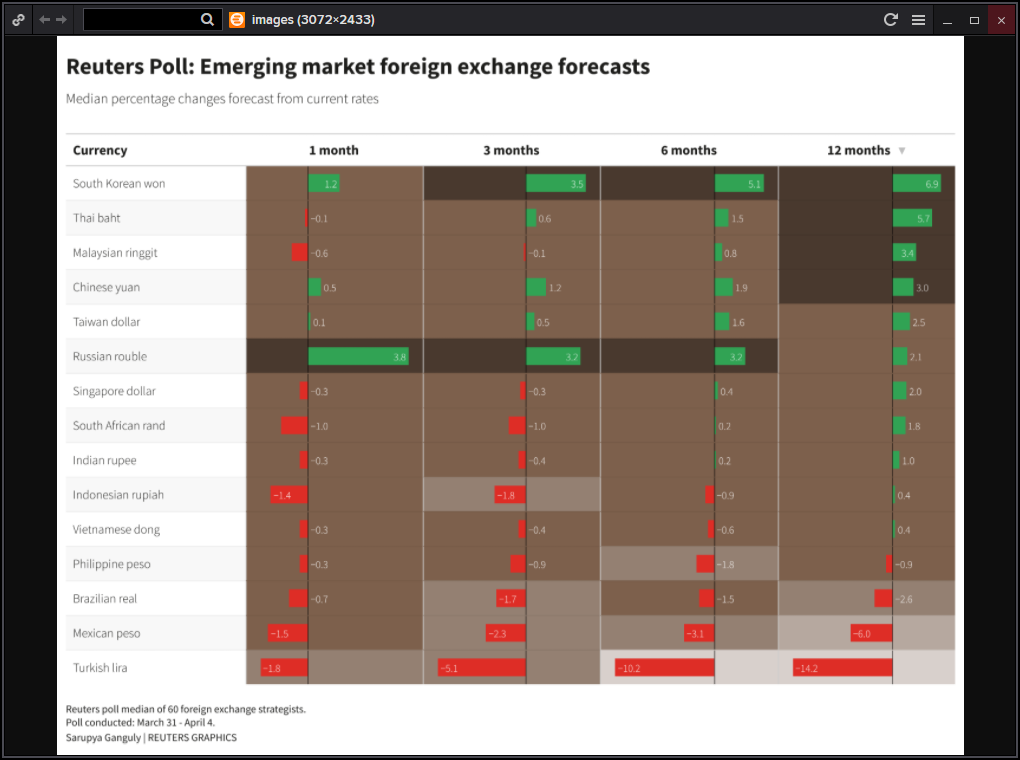

Most emerging market currencies are forecast to drift higher over the coming year as investors fret less about financial stability and snap up riskier assets, according to a Reuters poll of analysts who largely upgraded forecasts from last month.

While most of the currencies are seen gaining over the next 12 months, the March 31-April 4 poll of 60 foreign exchange analysts predicted volatility in the near term, and that only South Korea’s won and the Thai baht would recoup 2022 losses.

Emerging market (EM) assets have benefited from their exposure to commodities, which have held strong against a weaker U.S. dollar after the Federal Reserve signalled last month it was close to pausing an historically aggressive tightening cycle.

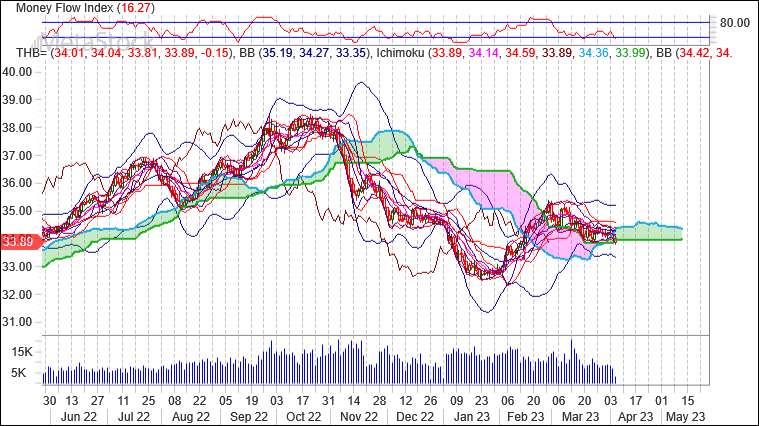

Momentum Indicators

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 19.4968. This is an oversold reading. However, a signal is not generated until the Oscillator crosses above 20 The last signal was a buy 11 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 40.13. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 25 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is -195.This is an oversold reading. However, a signal isn’t generated until the indicator crosses above -100. The last signal was a buy 8 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a sell 18 period(s) ago.