“Britcoin”, or known as “digital pound”, is the development of the British central bank digital currency (CBDC) and it’s affirmed by The Bank of England (BoE) and UK Treasury that they will support the development.

The discussion towards a British CBDC began in April 2021, when the UK Treasury, then led by current UK Prime Minister Rishi Sunak, established a joint task group with the Bank of England to assess the viability of a “digital pound” for British firms and people.

There have been several conversations and publications since then as both financial agencies considered the possible benefits and threats that a “digital pound” may bring to the UK economy. After 21 months of investigation and deliberation, it appears that both sides have reached an agreement.

CBDC is ‘likely’ to be required by the UK

According to a report provided to The Telegraph on Saturday, Bank of England Governor Andrew Bailey and Chancellor of the Exchequer (Treasury) Jeremy Hunt are expected to support the introduction of the state-owned digital currency based on an expected decrease in cash use as the world transitions to a cashless, digital economy.

“On the basis of our work to date, the Bank of England and UK Treasury judge that it is likely a digital pound will be needed in the future,” stated the governor and chancellor in a consultation paper obtained by The Telegraph through unnamed sources. “It is too early to commit to build the infrastructure for one, but we are convinced that further preparatory work is justified,”

According to The Telegraph, the Bank of England and the UK Treasury will make their stance public next week, laying out a plan for the effective introduction of the “digital pound” into the UK economy by 2030.

Anything so far, neither the Bank of England nor the UK Treasury has issued an official statement in response to the Telegraph’s report.

CBDC Concerns

As the name suggests, a central bank digital currency is a digital token issued and distributed by a country’s central bank. CBDCs are produced utilizing blockchain technology and have the same value and functions as fiat currency.

While many individuals and companies are enthusiastic about the prospect of a digital pound as the globe adopts blockchain technology, there are still considerable worries about the financial ramifications.

One big concern about the establishment of a “digital pound” is the ultimate demise of real money. The Bank of England, on the other hand, has repeatedly told the British people that the “digital pound” will be used alongside currency rather than as a substitute.

Another issue raised by the usage of digital currency is “state surveillance of people’s spending choices,” according to the Lords Economic Affairs Committee study on CBDCs, which was released on January 30, 2023.

However, according to the consultation paper obtained by The Telegraph, the Bank of England, and the UK Treasury, CBDCs will provide users with the same amount of anonymity as current forms of money, except in legal circumstances that may demand access to an individual’s transaction history.

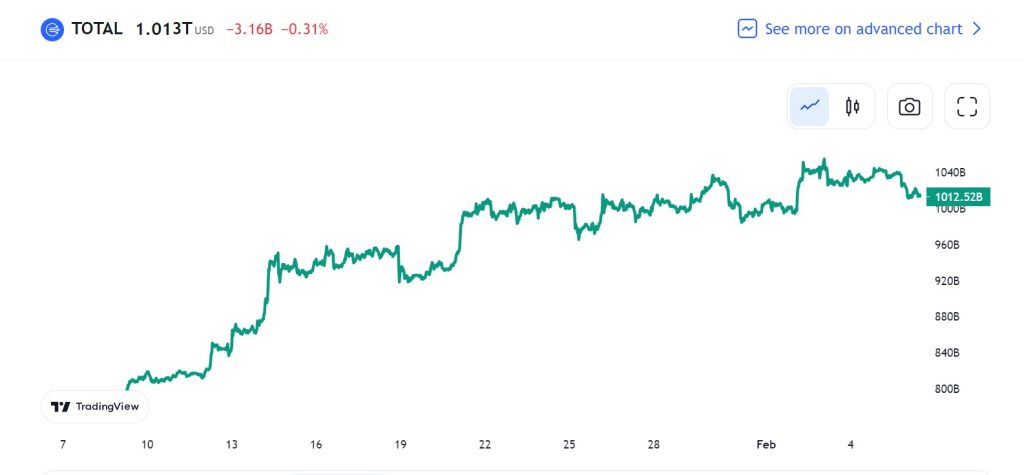

Nevertheless, the positive news of a “digital pound” merely demonstrates the blockchain industry’s amazing rise in recent years. However, cryptocurrency remains the most important use of blockchain. Following a very difficult year in 2022, the crypto market is on the rise again, with a total market worth of $1.013 trillion, according to TradingView statistics.

To speak to and learn more from a professional on Cryptocurrency, contact KXCO.IO.