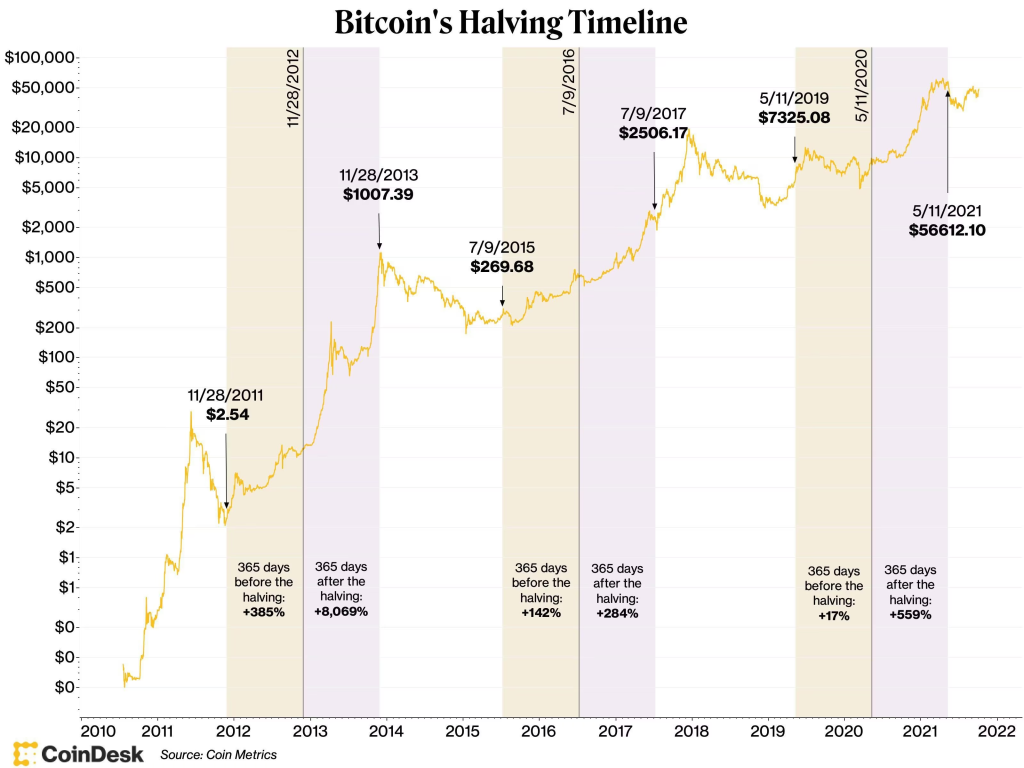

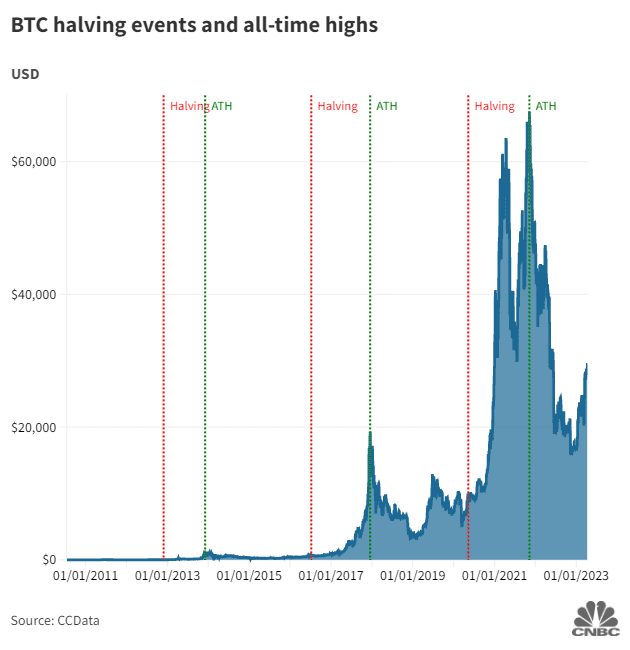

In the past, after a Bitcoin halving, there has often been a period of increased volatility in the price of Bitcoin. However, over the longer term, the price of Bitcoin has tended to increase following a halving event. The next Bitcoin halving is currently expected to occur in the year 2024, although the exact date is not yet known.

For example, following the most recent Bitcoin halving event in May 2020, the price of Bitcoin initially dropped but eventually rebounded and reached new all-time highs in early 2021. However, it’s important to note that the price of Bitcoin is influenced by a wide range of factors beyond just the halving event, and it can be difficult to predict exactly how the price will behave in the future.

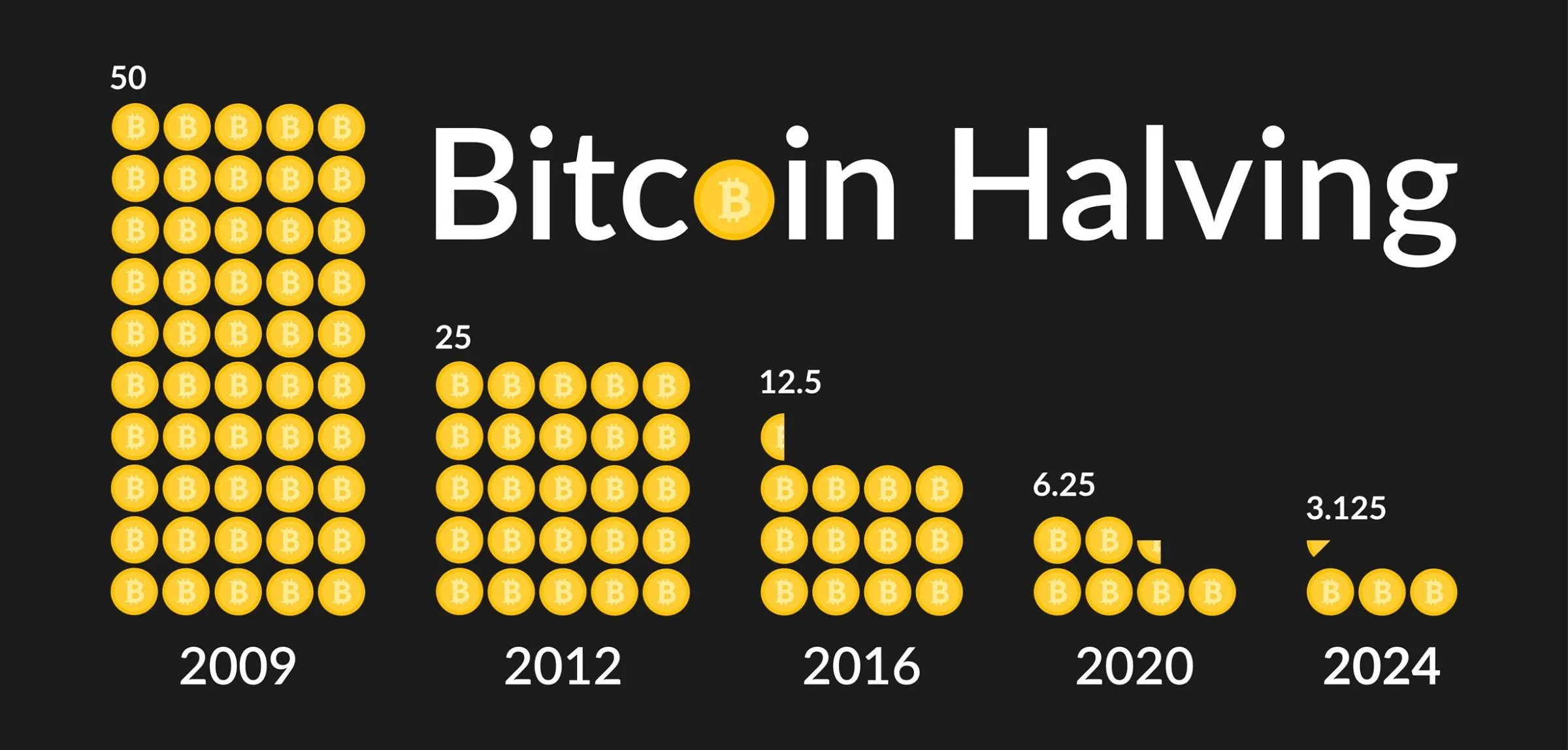

A Bitcoin halving is an event that occurs approximately every four years, in which the reward for mining a block of Bitcoin is cut in half. This reduces the rate at which new Bitcoins are created, which can have a significant impact on the Bitcoin market.

One reason the halving matters is because it reduces the supply of new Bitcoins entering the market, which could potentially increase demand and drive up prices. In the past, Bitcoin prices have tended to increase in the months leading up to a halving, although there is no guarantee that this pattern will continue in the future.

The halving also has implications for the mining industry, as it reduces the profitability of mining Bitcoin. Miners must compete to solve increasingly difficult mathematical problems in order to mine new blocks of Bitcoin and earn the block reward, and the reduced reward after a halving can make it less profitable for some miners to continue operating. This could potentially lead to a consolidation of mining power among larger players in the industry.

Overall, the Bitcoin halving is an important event in the cryptocurrency space that can have significant implications for market prices and the mining industry.