The global financial landscape is witnessing a significant shift as investors increasingly turn their attention towards commodities and hard assets. This growing interest is indicative of a new era, one marked by a commodities and hard assets bull run. In this article, we will explore the reasons behind this trend and shed light on the factors that suggest we are at the beginning of an exciting phase for these markets.

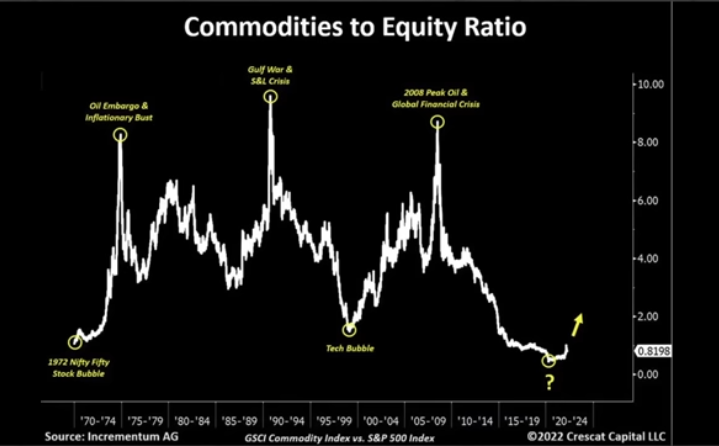

The commodities to equity chart might be the single most important chart of this decade. Looking at the chart, the ratio has been on a steep decline since the previous financial crisis of 08/09 and has been well below the historical average in recent years. This suggests that we are entering a new era characterized by commodities strengthening and a new cycle developing.

To understand why we might be at the beginning of a shift in momentum to the upside, we can begin to notice how cheap tangible assets have been compared to financial assets. On top of that, we have had 30 years of declining interest rates which translated into declining cost of capital rates. The effect of this capital environment over the last few decades resulted in inflated prices of financial assets. This can easily be extrapolated from the stock market as prices being much higher than fundamentals and therefore investors have been underallocated in tangible assets for quite some time.

This chart is simply showcasing that we are moving into a new era where tangible assets and commodities, and also commodity businesses in that regard, will receive a larger allocation in investor portfolios.

KXCO follows the thesis that Bitcoin the asset should have an allocation in every portfolio for multiple reasons pertaining to the fundamentals. We at KXCO provide guidance and clarity to our clients on these fundamentals and assist investors in optimzing their portfolio positions for the new environment we find ourselves in.

The Commodities to Equities Ratio: A Guide to Investing in Commodities

The commodities to equities ratio is a measure of the relative performance of commodities and equities. It is calculated by dividing the price of a basket of commodities by the price of a basket of equities. A high ratio indicates that commodities are outperforming equities, while a low ratio indicates that equities are outperforming commodities.

The commodities to equities ratio can be used to identify investment opportunities. For example, if the ratio is high, it may be a good time to invest in commodities, as they are likely to continue to outperform equities. Conversely, if the ratio is low, it may be a good time to invest in equities, as they are likely to outperform commodities.

The commodities to equities ratio can also be used to assess the overall health of the economy. A high ratio indicates that the economy is growing, as businesses are demanding more raw materials. A low ratio indicates that the economy is slowing down, as businesses are not demanding as many raw materials.

The commodities to equities ratio is a valuable tool for investors. It can be used to identify investment opportunities and assess the overall health of the economy.

Here are some of the factors that can affect the commodities to equities ratio:

- Economic growth: Commodities are used in the production of goods and services, so a growing economy will lead to increased demand for commodities. This will drive up the price of commodities and the commodities to equities ratio.

- Inflation: Inflation can also lead to higher commodity prices. This is because inflation erodes the purchasing power of money, which makes commodities more attractive as an investment.

- Geopolitical events: Geopolitical events, such as wars and natural disasters, can also affect the commodities to equities ratio. These events can disrupt supply chains and lead to shortages of commodities, which will drive up prices.

Investors who are considering investing in commodities should carefully consider the factors that can affect the commodities to equities ratio. By doing so, they can make informed investment decisions and reduce their risk.