A Precarious Position: US Default Risk Casts Doubt on the Dollar’s Future

The recent article from Reuters, titled “Dollar on Back Foot as US Default Risk Weighs,” sheds light on a concerning issue that has been haunting financial markets. The possibility of a US default has cast a long shadow over the stability of the dollar, raising questions about the future of the world’s reserve currency. In this opinion piece, we delve deeper into the implications of a potential US default, its impact on the global economy, the stock market, and the ramifications it may have for investors and businesses alike.

Beyond Currency Markets: Stock Market Turbulence in the Face of a US Default

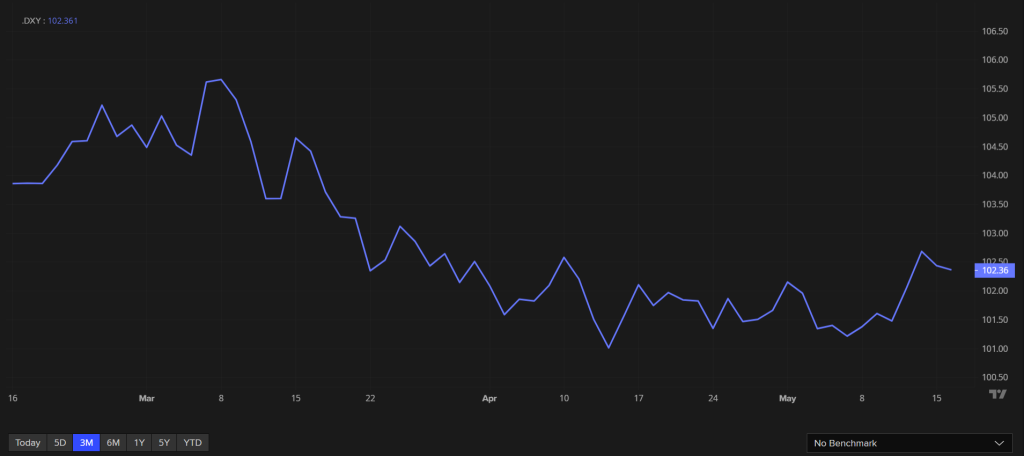

It is no secret that the United States’ growing national debt and political gridlock have put the country at risk of default. While a default remains a worst-case scenario, the mere threat of it has already weakened the position of the dollar in the currency markets. The article rightly points out that the dollar has been on the back foot as investors grow increasingly concerned about the ability of the US government to honor its debt obligations.

A US default would have severe repercussions on the global economy, and its impact would extend beyond currency markets. The stock market, a barometer of economic health and investor sentiment, would not be immune to the fallout. In the event of a default, uncertainty and market volatility would likely skyrocket, causing significant fluctuations in stock prices. Investors, both individual and institutional, would face heightened risks and potential losses, as confidence in the stability of the US financial system wanes.

Moreover, the interconnectedness of global markets means that the ripple effects of a US default would be felt worldwide. International investors, who hold significant stakes in US companies, would reassess their investment strategies and potentially reduce their exposure to the US stock market. Such a shift could lead to a decrease in demand for US equities, triggering a downward spiral in stock prices.

The repercussions of a US default would extend beyond the financial realm. The dollar’s status as the world’s reserve currency has long provided stability and confidence in international trade. A default would shake this foundation, eroding the trust that foreign investors have placed in the US financial system. The ensuing turbulence could trigger a domino effect, destabilizing financial markets, and potentially leading to a global economic downturn.

Furthermore, a weakened dollar and volatile stock market would impact various stakeholders. For investors, particularly those holding US Treasury bonds and other dollar-denominated assets, a default would result in significant losses. Financial institutions, too, would face the heat, as their balance sheets would take a hit from potential defaults on loans and other obligations. As a consequence, borrowing costs would rise, stifling economic growth and hampering the recovery from the pandemic.

The repercussions of a US default would extend beyond the financial and stock markets. The US dollar has long been a symbol of American economic strength and global influence. A default would not only dent the country’s image but also have geopolitical ramifications, potentially reshaping the dynamics of global power. It could undermine the US government’s ability to shape international policies and may even open doors for other currencies, such as the euro or the renminbi, to challenge the dollar’s supremacy.

A Collective Responsibility: Navigating the Uncertainties of a Weakened Dollar and Volatile Stock Market

The possibility of a US default is a matter of concern that demands urgent attention. The article from Reuters aptly highlights the current predicament faced by the dollar and the potential risks it poses to the global economy and the stock market. It is crucial for policymakers to prioritize resolving the national debt issue and working towards a sustainable fiscal path. Failure to address this issue could have far-reaching consequences, leaving investors, businesses, and economies vulnerable to the uncertainties of a weakened dollar and volatile stock market.

As investors and citizens, we must closely monitor developments related to the US default risk. By remaining informed and engaging in meaningful discussions, we can urge policymakers to take the necessary steps to safeguard the integrity of the global financial system. The future of the dollar, the stock market, and their impact on the world economy hang in the balance, and it is our collective responsibility to ensure a stable and prosperous future for all.

Opinion Piece by Nick Tan