#Americans #income #tax

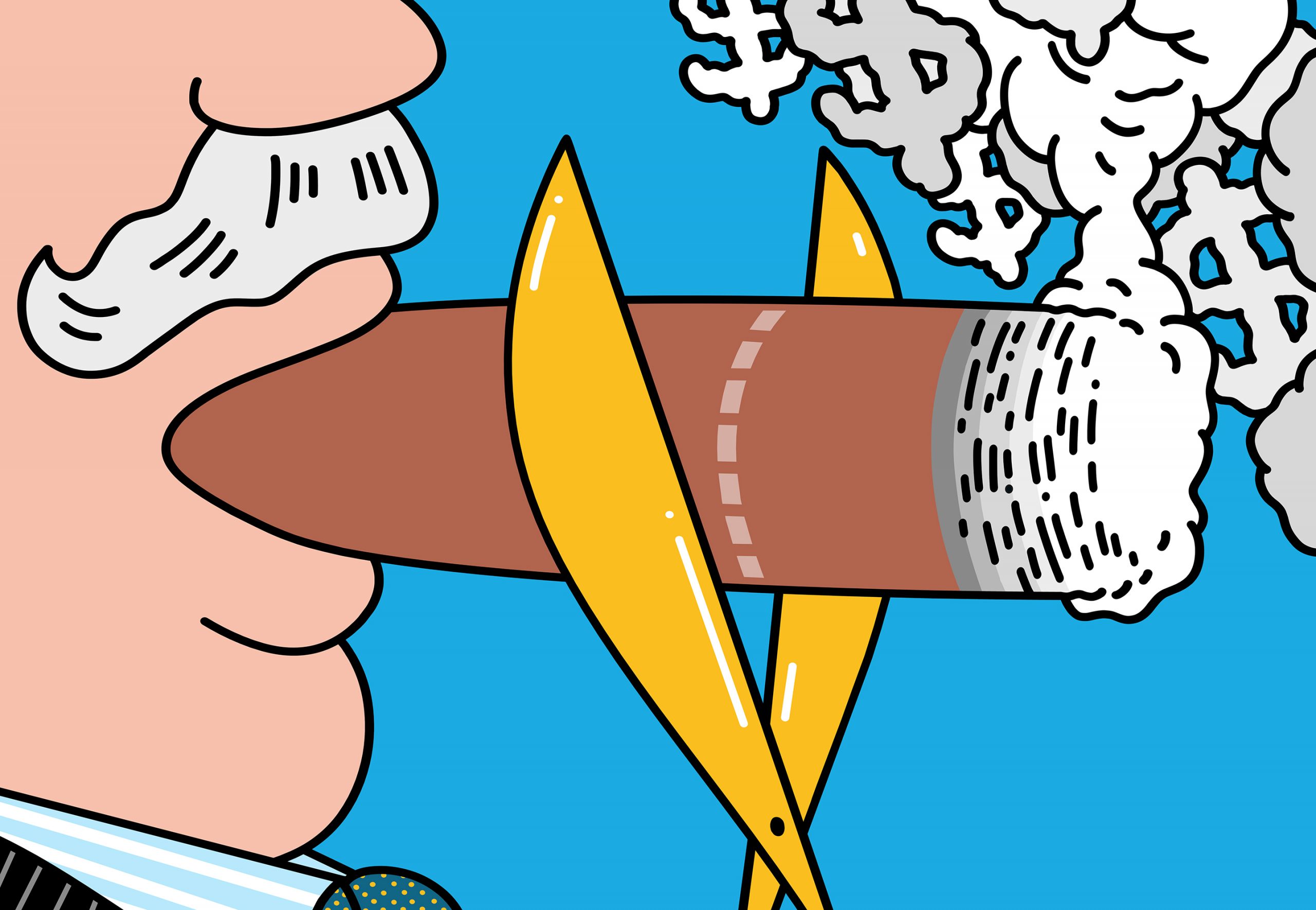

“Rich Americans and corporations pay the vast majority of federal taxes” — Paul Ebeling

In a study released Wednesday revealed that 60.6% of US households paid no federal income taxes during Y 2020, because of declines in income and boosts to government subsidies that wiped away tax liabilities, according to data from the Urban-Brookings Tax Policy Center.

The number of households owing nothing came in at 106.8-M, up from 75.90-M in Y 2019, the study, showed. The 60.6% proportion for last year compares with 43.3% over the 5 ys before the VirusCasedemic happened.

The number of familes owing no federal income taxes is projected to remain high for Y 2021, at approximately 101.7-M households, or 57.1%, according to the estimates.

The data underscore how several federal assistance measures, including stimulus payments, tax-free unemployment benefits and expanded child tax credits completely offset the federal tax bills that many families would have otherwise owed during the pandemic.

Households making less than $28,000 will not owe income taxes this year, nor will about 75% of families earning between $28,000 and $55,000, the Tax Policy Center found. About 43% of middle-income families will owe the IRS nothing on their earnings.

We believe that the federal government is unlikely to approve another round of stimulus payments. But, Democrats are pushing to renew an expansion to the child tax credit, which is set to expire at the end of this yr. That could mean more families with children see their tax bills cut.

Have a prosperous day, Keep the Faith!