#crypto #bitcoin #mining

$BTCUSD $JPM

“JPMorgan says the reduced cost of producing Bitcoin may hurt the price of the leading digital asset”–Paul Ebeling

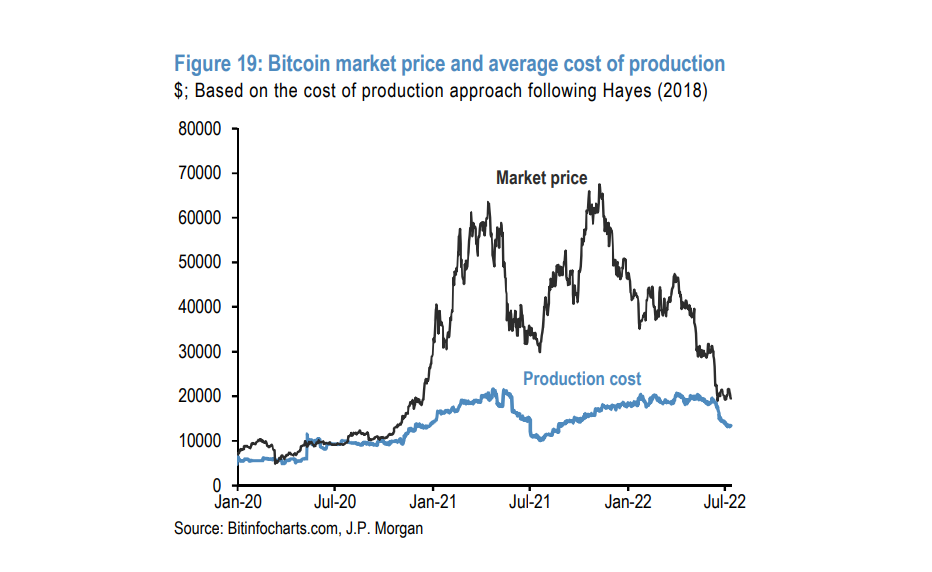

According to a new report, JPMorgan analysts say Bitcoin’s cost of production has dipped from $24,000 in June to $13,000 now, a decrease that may not be so great for the Top crypto asset by market cap’s price.

Strategists led by Nikolaos Panigirtzoglou find that the lowered cost of production is most likely due to a decline in electricity use, which they say is related to BTC miners deploying more efficient mining rigs rather than less-efficient miners leaving in droves.

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward.

The production cost is perceived by some market participants as the lower bound of the Bitcoin’s price range in a bear market.”

Last month, the banking giant’s strategists noted the crypto industry’s latest widespread downturn may soon be over as the market’s deleveraging process is nearing its end.

Bitcoin is changing hands at $21,286.01 at time of writing, a 3.6% increase during the last 24 hrs and a 18% uptick from its seven-day low of $17,760.

A tip of my hat to sovereign individuals with satoshis and Bitcoin in cold storage with our firm. Click here

Have a prosperous weekend, Keep the Faith!