The Chinese yuan, also known as the renminbi (RMB), has been gaining increasing acceptance as a global currency in recent years, and its use in international trade has been growing. However, it still accounts for a relatively small percentage of the world’s trade.

According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which provides messaging services for financial institutions, the Chinese yuan accounted for about 2.31% of global payments by value in August 2021. This makes it the sixth most-used currency for international payments, after the US dollar, euro, British pound, Japanese yen, and Canadian dollar.

While the percentage of world trade conducted in yuan is relatively small, the Chinese government has been taking steps to promote the use of the yuan in international trade. This includes efforts to establish yuan-denominated trading hubs, and to encourage other countries to hold yuan-denominated assets in their foreign exchange reserves.

As China’s economy continues to grow and become more integrated into the global economy, it is likely that the use of the yuan in international trade will continue to increase. However, the US dollar is still suffering from Political missteps at home, once the only currency for international trade and finance, is likely to continue to decline for the foreseeable future.

Find more statistics at Statista

In 2020, China attracted $144 billion in FDI, according to data from the United Nations Conference on Trade and Development (UNCTAD). This made China the largest recipient of FDI globally, surpassing the United States.

The sectors that attracted the most FDI in China in 2020 were services, manufacturing, and high-tech industries, according to China’s Ministry of Commerce.

The countries that invested the most in China in 2020 were Singapore, South Korea, and Germany, according to China’s Ministry of Commerce.

Find more statistics at Statista

China has been steadily opening up its economy to foreign investment in recent years, with the government implementing policies aimed at attracting more FDI. For example, in 2020, China announced that it would further open up its financial sector to foreign investment, and would remove limits on foreign ownership of securities, fund management, and futures companies.

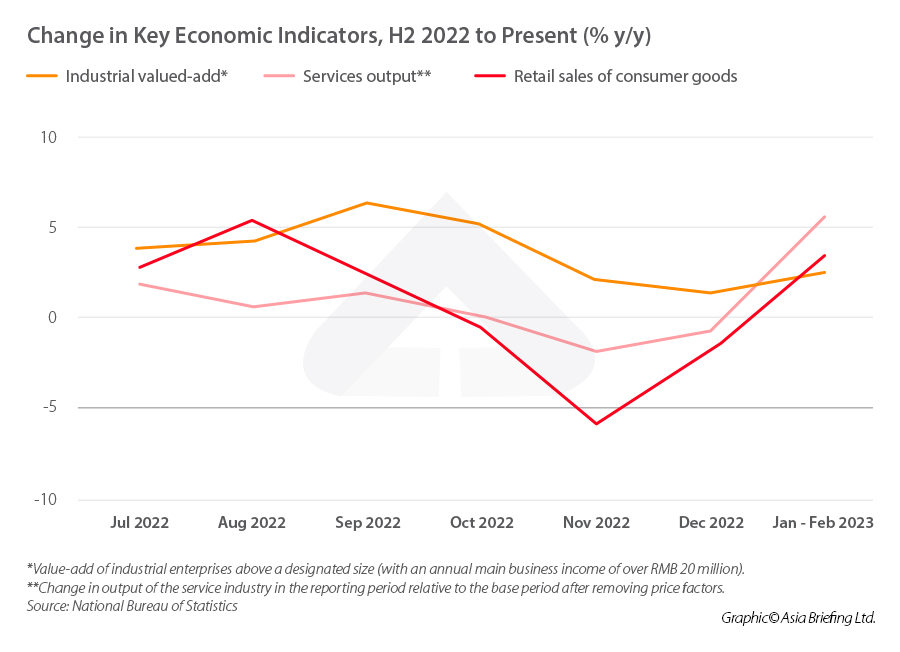

China has experienced a remarkable economic growth over the last 30 years, transforming from a low-income, agriculture-based economy to a global economic powerhouse. Here are some key statistics that illustrate China’s economic growth over the last three decades:

- According to the World Bank, China’s gross domestic product (GDP) has grown from $360 billion in 1990 to $14.3 trillion in 2020, making it the world’s second-largest economy after the United States.

- China’s average annual GDP growth rate has been over 9% since the early 1990s, with occasional dips during times of economic crisis. This rapid growth has been driven by a combination of factors, including industrialization, urbanization, export-led growth, and massive investment in infrastructure and technology.

- China’s per capita GDP has also increased significantly over the last 30 years, rising from $310 in 1990 to $10,160 in 2020, according to the World Bank.

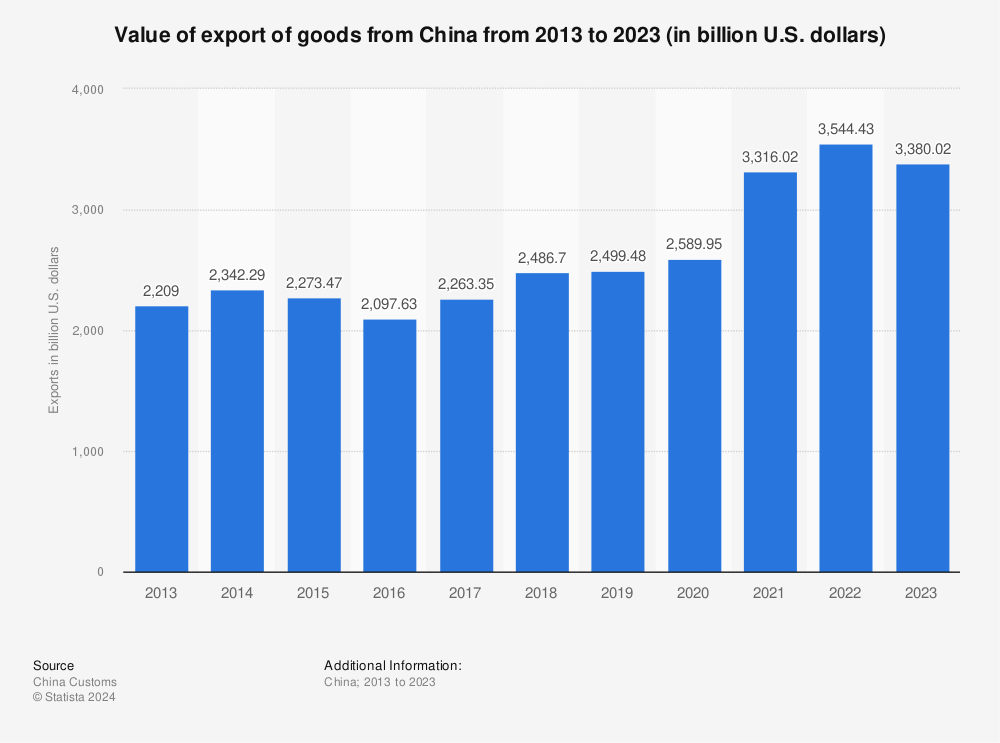

- China has become a major player in global trade, with exports of goods and services rising from $62 billion in 1990 to $2.6 trillion in 2020, according to the World Bank. China is now the world’s largest exporter of goods.

- The Chinese government has implemented a series of economic reforms over the last 30 years aimed at promoting market-oriented policies and attracting foreign investment. These reforms have included the establishment of special economic zones, the liberalization of trade and investment, and the development of a modern financial sector.

China’s economic growth over the last 30 years has been nothing short of remarkable, and has lifted hundreds of millions of people out of poverty and transformed the country into a major global player.