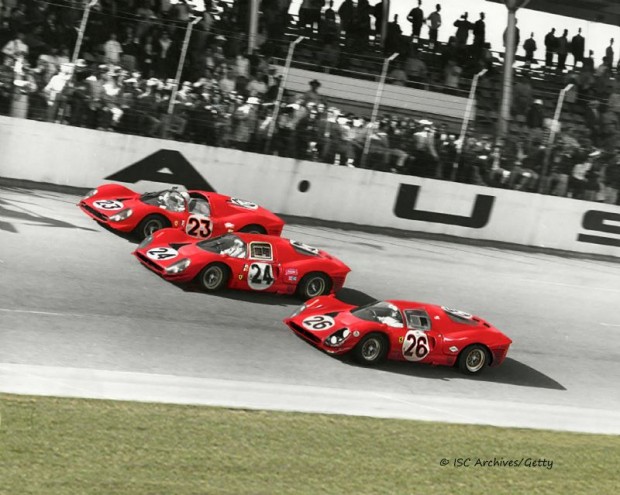

#Ferrari #330P4 #Daytona

$RACE $MS $F

Analyst Update: Ferrari has business lines that could potentially lead the Italian Supercar maker’s stock to run up to a 265 price target according to Morgan Stanley.

As The Scuderia posting victories in endurance racing and F1 during the late ‘50s and early 1960s, they became the most popular brand in the automotive world.

Now comes FoMoCo (NYSE:F) and the Blue Oval wanted to boost its image and decided that buying out Ferrari would be the ultimate marketing ploy. In Y 1963, a delegation went to Maranello to try and persuade Enzo Ferrari to sell the controlling stake, but after nearly a month of negotiations, everything fell apart, as Ferrari used Ford’s offer to get a better deal from Fiat.

This enraged Henry Ford II who decided to start a new racing program meant to end Ferrari’s domination in the world of endurance racing. With the help of Carroll Shelby and his team, Ford managed to build an excellent car that beat The Scuderia’s in Y 1966 and the epic Ford Vs Ferrari rivalry was now a happening.

Since the 330 P3 had failed due to engine overheating and gearbox problems, it needed to be fundamentally redesigned. The unreliable Tipo 593 ZF transmission was canned and replaced with a new in-house developed 5-speed unit that would be mated to a radically improved engine.

Franco Rocchi was the man in charge of overhauling the powerplant. It became the 1st Ferrari engine to employ 3 valves per cylinder and got a pair of new heads derived from an F1 unit.

Plus, the Lucas fuel injection system which debuted on the P3 and sat between the cylinder banks was now moved between the camshafts to improve efficiency.

With these upgrades, the long-block V12 was now capable of generating around 450 hp, but more importantly, it was much more reliable.

While the bodywork was nearly identical to that of the P3, the tubular steel chassis saw several improvements which lead to a shorter wheelbase with a wider track.

And so 3 new cars were built, all as closed-top Berlinetta’s.

Then, with the addition of ex-Ford driver and Le Mans winner Chris Amon, the Y 1967 season kicked off in America. After 560 test laps at Daytona a few months before the 24-hour race, the P4 was ready for its official debut.

From start to finish, the 3 Ferraris dominated and eventually crossed the line simultaneously, replicating Ford’s iconic Le Mans photo from the previous year.

This new photo became known as ‘The Revenge of Il Commendatore’ and legend has it that Enzo kept it by his side until he died.

The Americans won the 2nd race at Sebring 2 months later, after which Ferrari came back on Top in Italy, at Monza. Next the 2 manufacturers concentrated on the 24-hour race in France.

The 35th running of the legendary race was shaping up to be 1 for the history books.

Ferrari came with the P4 Spyder that finished 1st at Daytona and 2 P4s as works cars. Additionally, the last remaining P4 and 3 412P were lent to privateers Jacques Swaters and Johnny Claes’ Belgian National Team.

Ford came with aerodynamically improved GT40 Mk IVs that were very unstable at high speeds but significantly faster than any other car.

As the night fell, the Chris Amon’s P4 Spyder suffered a puncture. Because of a faulty mallet, it could not be fixed on the side of the track, so the Aussie had to creep back to the pits, losing the 5th position. Unfortunately, sparks from the wheel hub ignited a fire in the engine bay so Amon had to bail out as the car burned up.

The 2 remaining P4s soldiered on and next morning were lapping the track 10 secs faster than the leading Ford of Dan Gurney and AJ Foyt. And #1 GT40 crossed the finish line 1st, with 5 laps over the Ferraris which completed the race in 2nd and 3rd.

Enzo admitted that his cars were just not good enough, yet all was not lost for the Scuderia and the 330 P4. By the end of the season, Ferrari had secured the WSC manufacturers’ title, with Ford finishing 3rd.

The 1967 Ferrari 330 P4 is considered by many enthusiasts and experts as the best endurance racer ever built in Maranello. It made Enzo proud at Daytona where it obliterated the Fords.

Ferrari is The Aristocrat of the automotive sector.

Ferrari closed Thursday at 205.66 within its 52 wk range of 127.73 – 233.66 in NY. It’s all time high in NY was marked at 233.66 intraday on 29 December.

Key technical indicators are Bearish in here, but Bullish long term. The candlestick pattern indicates the confirmation of the break out at 196.01 on 3 November and confirmed.

The Key support is at 200.65, and the Key resistance is now at 207.35. The 7 July Doji candlestick augurs a return to the Very Bullish trend.

Note: At the beginning of Y 2020 I called RACE at 230 by year’s end, the stock was trading at 165.22 on 1 January 2020, on 29 December 2020 it marked 233.66 intraday, its all time high

The Maranello Outfit’s shares were raised to Buy from Hold at HSBC, and Buys at Morgan Stanley and Bank of America.

UBS is now calling the stock at 365. Citi downgraded the stock from Neutral to sell. I have not seen any other Street downgrades.

Ferrari will continue to create value in the long term as it becomes the world’s 1st Super Luxury brand.

Ferrari is a quality 1st long term luxury products investment, BAML raised its call to 270 long term and MS raised its call to 265 Thursday.

I raised my long term target to 375, a Strong Bull call, the strongest on the Street and am holding the mark during this recent profit taking, and seeing RACE as a buying opportunity.

Ferrari has an average rating of Buy and a consensus target price at 231.99.

The Maranello Outfit’s shares were raised downgraded from Buy to Hold at HSBC.

Ferrari will continue to create value in the long term. Ferrari is a quality 1st long term luxury products investment, and I am calling it 375 long term, the Top on the Street, and adjusting it to 250/share short term.

A number of large investors have recently bought shares of RACE, and there have been very few instances of insider selling over the past yr that we have seen. And Ferrari continues to buy back its stock in here.

The stock is considered defensive in the sector.

Have a prosperous day, Keep the Faith!