#USD #EUR #US #China #PBoC #greenback #Fed #CBCD #digital #money

In their January 2022 report, ‘Money and Payments – The US Dollar in the Age of Digital Transformation,’ the Fed said monetary policy should not and cannot be dictated by decisions made by other sovereign states, there will always be a question of competitive advantages.

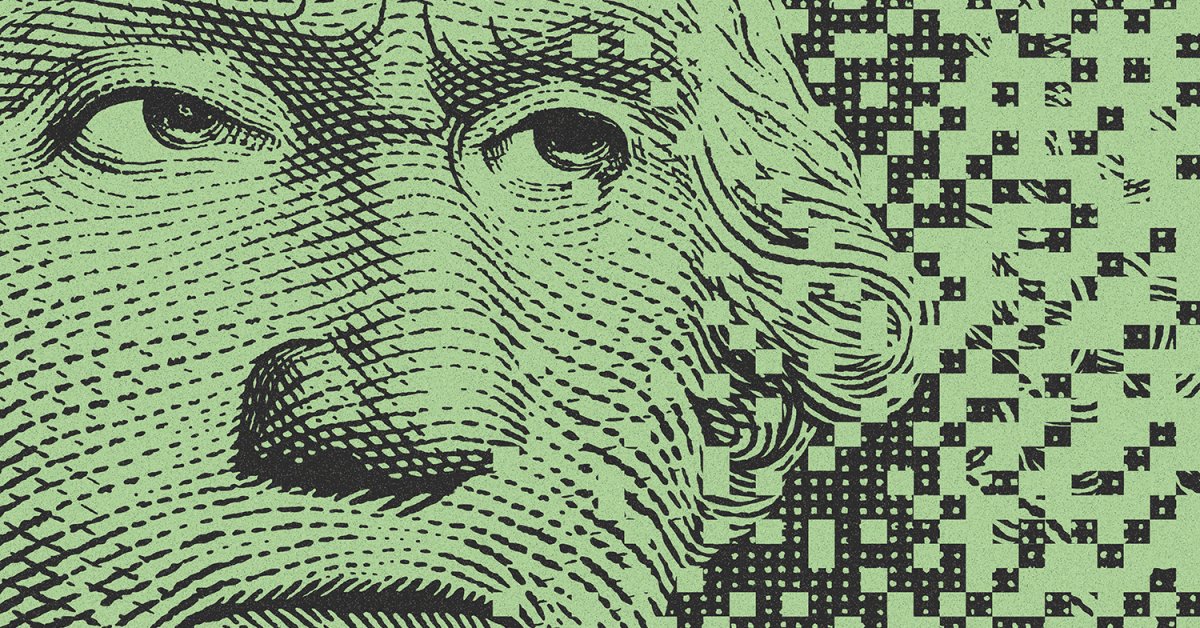

The Greenback is currently the global reserve currency. If the United States fails to act, and if China moves forward with their own CBDC, there is the Big Q: Will that change?

The Big A: The Chinese have been testing their own CBDC for the past yr, and there is no denying that as global powers go, they have the most advanced digital currency program. However, to say that the USD will be replaced by a time advantage of a yr is short-sighted.

In the report, the Fed said that it “will only take further steps toward developing a CBDC if research points to benefits for households, businesses and the economy overall that exceed the downside risks, and indicates that CBDC is superior to alternative methods. Furthermore, the Federal Reserve would only pursue a CBDC in the context of broad public and cross-governmental support.” With that we believe the US is in the lead.

It is accepted by many in the industry that blockchain technology is a transformative technology that will completely upend the way that we interact with our financial system. So, it is not overly bold to hypothesize that research points to benefits that exceed the risks.

The Euro currently is the 2nd most commonly used currency in foreign exchange reserves. When the Fed and the rest of our policy thinkers consider the Big Q it is Key to look at the question from all sides and in a futuristic way, because digital currencies are not going away.

Have a healthy, prosperous weekend, Keep the Faith!