Factors Hitting Markets Next Week: A Look at US and UK Data Releases

As we head into the new week, investors are closely watching key data releases in both the US and the UK, which are expected to have significant implications for market sentiment and monetary policy decisions.

US Data Highlights: Core Inflation and Retail Sales

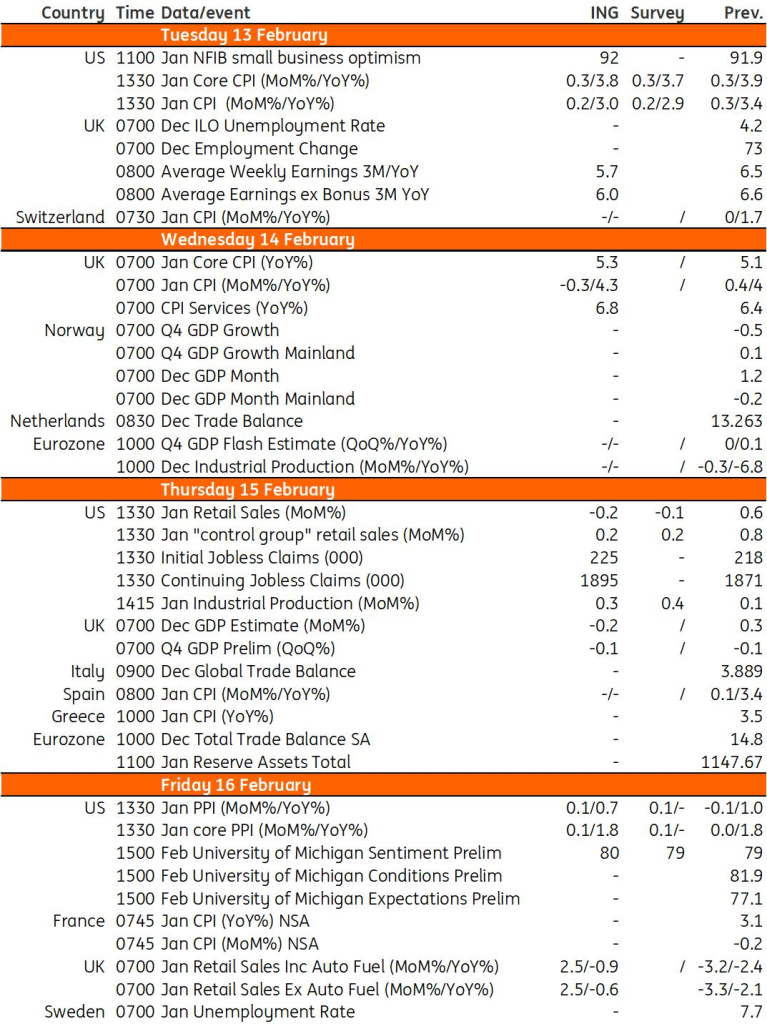

In the US, the main data highlights include the release of core inflation data and retail sales figures. Analysts are expecting soft retail sales numbers, particularly due to poor auto sales figures, possibly influenced by bad weather conditions and high borrowing costs for credit cards and car loans.

The Federal Reserve’s preferred inflation measure, the core PCE deflator, is already tracking at an appropriate rate, and labor market inflation pressures are showing signs of easing. However, the Fed remains cautious and is looking for more data consistency before making any monetary policy adjustments.

The core inflation rate is expected to increase by 0.3% month-on-month, with risks slightly skewed towards a 0.2% outcome. Retail sales may be subdued, while industrial production could see a lift from strong utilities demand.

UK Data Releases: Services Inflation and Wage Growth

In the UK, investors will be monitoring a flurry of data releases, including services inflation and private-sector wage growth. Services inflation is expected to notch higher, partly due to volatile moves in airfares, while wage growth may drop noticeably, reflecting the recent cooling in the jobs market.

Growth figures for the UK economy are also anticipated, with December’s plunge in retail sales potentially nudging the economy into another slight contraction. However, analysts believe this contraction is more technical than fundamental, and the overall outlook for the UK economy remains positive, with expectations of modest growth this year.

Market Outlook and Monetary Policy

The data releases next week will play a crucial role in shaping market sentiment and guiding monetary policy decisions. While the US Federal Reserve is expected to maintain a cautious stance, the Bank of England may consider rate cuts depending on inflation and wage growth trends.

Overall, investors will closely monitor economic indicators for insights into the trajectory of both the US and UK economies, with implications for global markets and investor sentiment.

Shayne Heffernan