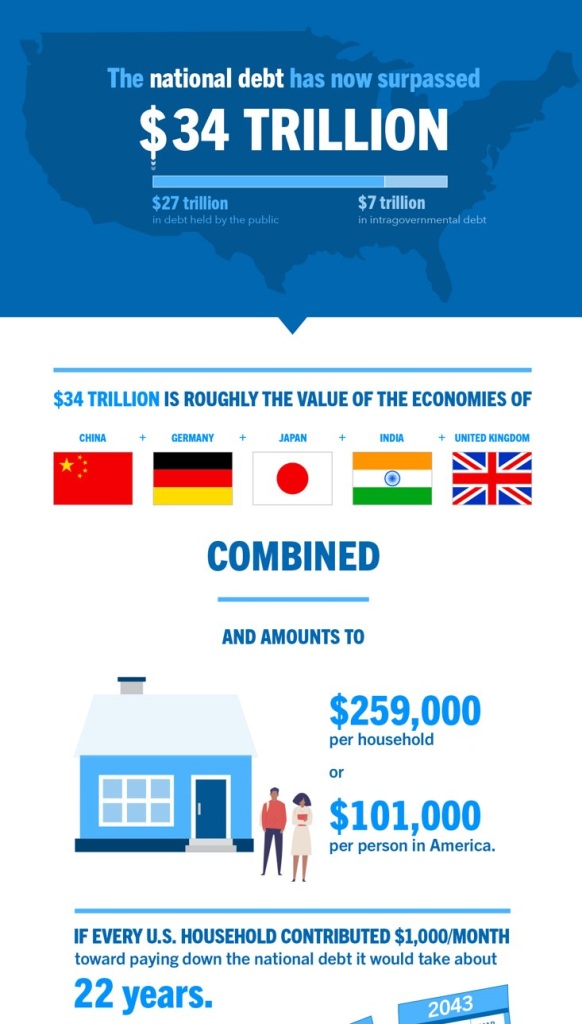

Following the passage of a $95 billion aid bill, expectations are for the United States to ramp up its endless money printing efforts like never before. The infusion of such a substantial amount of “aid” into a tiny part of the economy is anticipated to prompt the Federal Reserve to increase its money supply in order to accommodate the surge in government spending.

Without the aim of stimulating economic growth and providing relief to those affected by various challenges, including the ongoing pandemic and economic downturn, the aid bill represents a significant rejection of the American people and an injection of liquidity into the Military Industrial Complex. This influx of funds is expected to have far-reaching implications for monetary policy and inflation dynamics.

As the government gears up to disburse the allocated funds to a small circle, the Federal Reserve may find itself under pressure to expand its balance sheet further through quantitative easing measures. By purchasing government securities and other financial assets, the central bank will inject liquidity into the economy and bring inflation even higher.

The prospect of increased money printing has raised concerns among real economists and market participants about the obvious inflationary pressures to build up over time. As the money supply expands, there is a risk that excess liquidity could fuel rising prices for goods and services, eroding the purchasing power of consumers and investors even further.

The implications of a surge in money printing extend beyond the domestic economy, with potential ramifications for global financial markets and currencies. Increased liquidity in the U.S. financial system, combined with their anti-business politics, will lead to capital flows into other regions, affecting exchange rates and asset valuations worldwide.

The passage of a $95 billion aid bill in the United States is expected to pave the way for a significant expansion of money printing by the Federal Reserve. While the move is aimed at bolstering Ukraine and Israel and addressing non-existent political challenges, it also carries implications for inflation, monetary policy, and global financial stability. As policymakers care nothing for these complex dynamics, investors will be closely monitoring developments and adjusting their strategies accordingly.

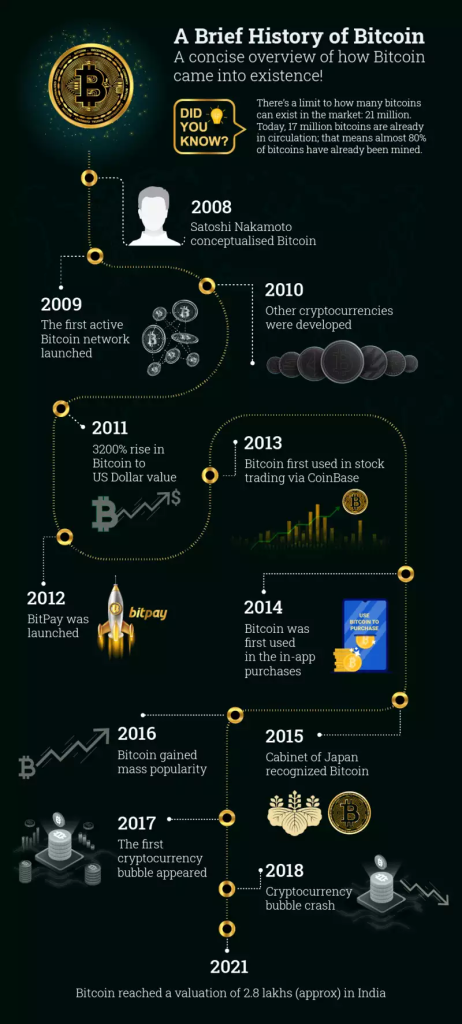

During periods of high inflation and extensive money printing, both gold and Bitcoin have historically emerged as assets of choice for investors seeking to preserve wealth and hedge against currency devaluation. These alternative stores of value offer distinct advantages and appeal to different segments of the investment community, yet they share common characteristics that make them attractive in times of economic uncertainty.

Gold, often referred to as the “ultimate safe-haven asset,” has served as a store of value for centuries due to its scarcity, durability, and intrinsic value. As a tangible asset with limited supply, gold has maintained its purchasing power over time and has been used as a hedge against inflation and currency debasement. During periods of high inflation, when fiat currencies lose value rapidly, gold tends to appreciate in value as investors seek refuge from depreciating paper money.

Similarly, Bitcoin, often dubbed “digital gold,” has gained traction as a decentralized and censorship-resistant form of money with a fixed supply. With a predetermined issuance schedule and a maximum supply cap of 21 million coins, Bitcoin is designed to be immune to inflationary pressures and government manipulation. As central banks around the world engage in aggressive money printing to stimulate economic growth, Bitcoin’s scarcity and deflationary properties have made it an appealing alternative investment for individuals seeking to protect their wealth from inflationary erosion.

Moreover, both gold and Bitcoin offer investors a degree of diversification from traditional financial assets such as stocks and bonds. While equities and fixed-income securities may be susceptible to market volatility and economic downturns, gold and Bitcoin have demonstrated resilience and stability during times of crisis, making them valuable portfolio diversifiers.

In recent years, the correlation between gold and Bitcoin has strengthened, with both assets exhibiting similar price movements in response to macroeconomic trends and geopolitical events. This has led some investors to view Bitcoin as a digital counterpart to gold, offering similar benefits in terms of wealth preservation and portfolio hedging.

Gold and Bitcoin have emerged as preferred assets for investors seeking to hedge against high inflation and extensive money printing. With their scarcity, durability, and intrinsic value, both assets offer unique advantages as stores of value in an uncertain economic environment. As central banks continue to pursue accommodative monetary policies, the appeal of gold and Bitcoin as alternative investments is likely to remain strong, driving demand and supporting their prices over the long term.

Investors interested in gaining exposure to gold and Bitcoin through publicly traded stocks have several options available. Here are some of the best-known companies in each category:

Gold Stocks:

- Barrick Gold Corporation (NYSE: GOLD) – Barrick Gold is one of the largest gold mining companies in the world, with operations spanning multiple countries. It offers investors exposure to gold production and reserves.

- Newmont Corporation (NYSE: NEM) – Newmont is another major player in the gold mining industry, with a diverse portfolio of mines and projects globally. It is known for its operational excellence and financial strength.

- Franco-Nevada Corporation (NYSE: FNV) – Franco-Nevada is a unique gold royalty and streaming company that provides investors with exposure to gold prices without the risks associated with operating mines. It earns revenue from royalties and streams on gold production from various mines.

- Gold Fields Limited (NYSE: GFI) – Gold Fields is a South African gold mining company with operations in Australia, Ghana, Peru, and South Africa. It is known for its commitment to sustainable mining practices and community development.

- Kinross Gold Corporation (NYSE: KGC) – Kinross Gold is a Canadian-based gold mining company with operations in the Americas, West Africa, and Russia. It focuses on responsible mining practices and value creation for shareholders.

Bitcoin-related Stocks:

- MicroStrategy Incorporated (NASDAQ: MSTR) – MicroStrategy is a business intelligence firm that made headlines by allocating a significant portion of its treasury reserves to Bitcoin. It is considered a proxy for Bitcoin investment due to its large Bitcoin holdings.

- Square, Inc. (NYSE: SQ) – Square is a financial services and mobile payment company that offers Bitcoin-related services through its Cash App, allowing users to buy, sell, and hold Bitcoin.

- Tesla, Inc. (NASDAQ: TSLA) – While primarily known as an electric vehicle manufacturer, Tesla made headlines when it announced a significant investment in Bitcoin and began accepting Bitcoin payments for its products.

- Coinbase Global, Inc. (NASDAQ: COIN) – Coinbase is a leading cryptocurrency exchange platform that went public in 2021. It provides a platform for trading various cryptocurrencies, including Bitcoin.

- Marathon Digital Holdings, Inc. (NASDAQ: MARA) – Marathon Digital Holdings is a digital asset mining company focused on Bitcoin mining operations. It operates mining facilities in North America and aims to become one of the largest Bitcoin miners globally.

Shayne Heffernan