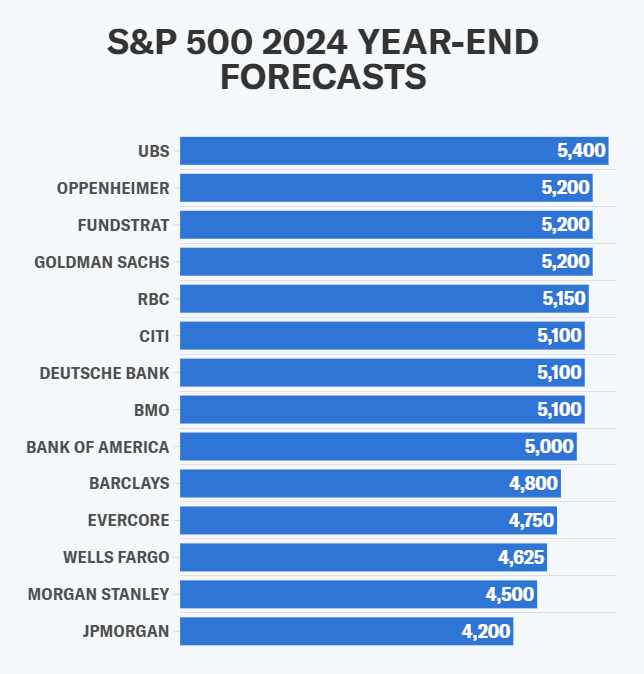

The S&P 500 (^GSPC) is scaling new heights in 2024, surpassing even the most optimistic forecasts from Wall Street strategists. The surge in stocks has propelled the benchmark index above the average year-end target less than two months into the year, prompting two major firms to revise their projections upwards.

Goldman Sachs, a leading investment bank, recently raised its year-end target for the S&P 500 from 5,100 to 5,200. Following suit, UBS Investment Bank also increased its target to 5,400, up from the previous call of 5,100. This represents a nearly 8% surge from Tuesday’s opening price.

“Despite our bullish outlook, it appears we were not bullish enough,” remarked Jonathan Golub, head of UBS Investment Bank’s equity strategy team.

Both Goldman Sachs and UBS cited a more optimistic outlook for corporate earnings as a key factor driving the upward revisions. Analysts now project S&P 500 companies’ earnings to grow by 3.2% in the fourth quarter, up from a 1.9% projection a month ago, according to FactSet. For the full year 2024, a robust growth rate of 10.9% is anticipated.

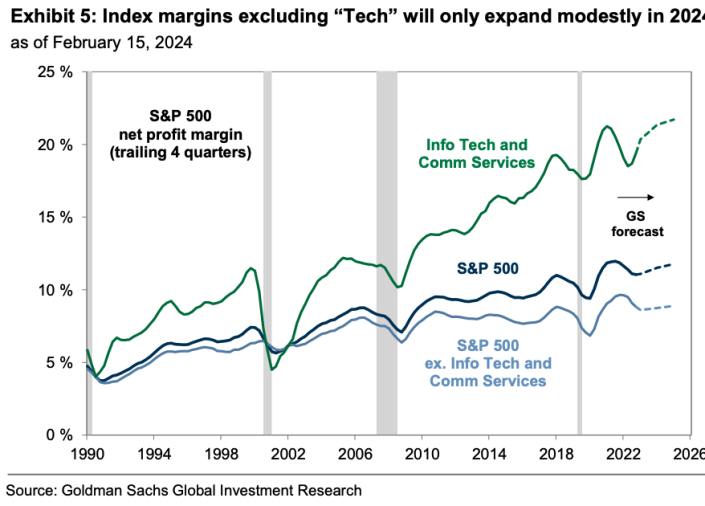

In a research note, David Kostin, chief US equity strategist at Goldman Sachs, emphasized that earnings growth will be the primary driver of further upside for stocks throughout 2024. This optimistic outlook is fueled by upgraded forecasts on US economic growth and mega-cap profit margins, particularly in the technology sector.

Goldman Sachs anticipates that the Information Technology (XLK) and Communication Services sectors (XLC), which house major tech players like Apple (AAPL), Alphabet (GOOGL, GOOG), and Microsoft (MSFT), will lead earnings growth in 2024. Kostin highlighted the importance of demand drivers such as AI growth and consumer strength in supporting revenue growth for these sectors.

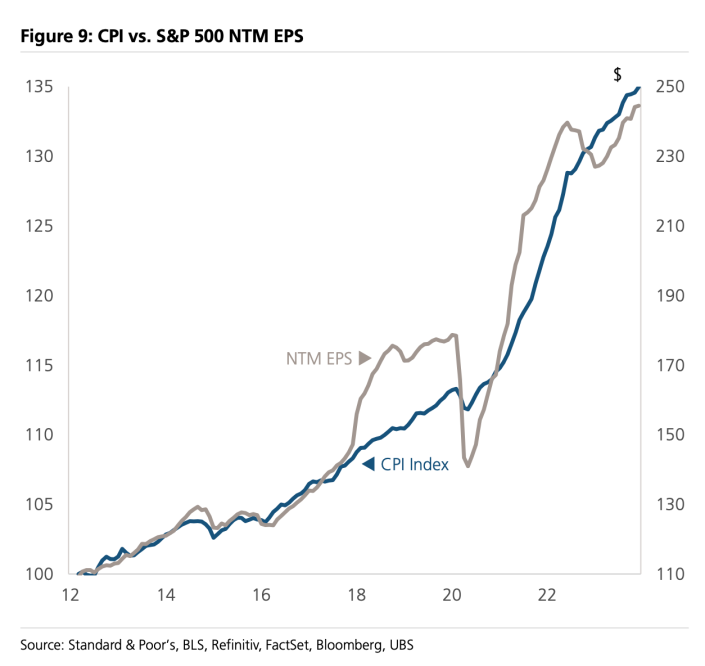

Despite concerns surrounding sticky inflation, UBS’s Golub suggests that higher inflation could actually benefit stock prices in the long run. “Returns and profits are measured in nominal dollars… higher inflation tends to be a positive for stock prices,” Golub explained. Despite recent market volatility triggered by inflation fears, Golub remains optimistic about the market’s resilience.

Wall Street’s bullish outlook for the S&P 500 underscores confidence in the resilience of the market and the potential for further gains in 2024. While risks remain, including inflation concerns, the overall sentiment from major banks points towards continued optimism and potential for growth in the months ahead.

| Company | Ticker |

|---|---|

| Apple | AAPL |

| Alphabet | GOOGL, GOOG |

| Microsoft | MSFT |

| Amazon | AMZN |

| Meta | META |

| Tesla | TSLA |

| Nvidia | NVDA |

Knightsbridge’s Positive Outlook on the S&P 500

Amidst the dynamic landscape of the stock market, Knightsbridge remains steadfast in its positive outlook on the S&P 500 (^GSPC). As we navigate the currents of uncertainty, we see abundant opportunities for growth and prosperity in the months ahead.

The S&P 500, a barometer of the broader market, continues to demonstrate resilience and strength, reaching new heights and defying earlier projections. With each record high, the index reaffirms its position as a beacon of stability and growth in an ever-changing world.

At Knightsbridge, we are optimistic about the S&P 500’s trajectory for several reasons:

- Economic Recovery: The ongoing global economic recovery, fueled by fiscal stimulus measures and vaccination efforts, bodes well for corporate earnings and market sentiment. As businesses reopen and consumer confidence rebounds, we anticipate a resurgence in economic activity that will drive stock prices higher.

- Corporate Earnings Growth: Earnings season has brought positive surprises, with many companies reporting robust financial results that exceed expectations. Strong corporate earnings provide a solid foundation for further market gains, reflecting the underlying strength of the economy and corporate sector.

- Technological Innovation: Innovation continues to drive progress and disrupt traditional industries, creating new opportunities for growth and investment. Companies at the forefront of technological advancements, particularly in areas such as artificial intelligence, cloud computing, and e-commerce, are well-positioned to thrive in the current environment.

- Monetary Policy Support: The Federal Reserve’s commitment to accommodative monetary policy and low interest rates remains a key driver of market liquidity and investor confidence. With central banks around the world maintaining a dovish stance, investors have ample liquidity to support asset prices and fuel market expansion.

- Long-Term Investment Perspective: Despite short-term fluctuations and occasional market volatility, we maintain a long-term perspective on the S&P 500 and the broader equity market. History has shown that equities have delivered attractive returns over the long term, and we believe that staying invested in high-quality companies is a prudent strategy for wealth accumulation.

In conclusion, Knightsbridge remains optimistic about the prospects of the S&P 500 and the opportunities it presents for investors. While challenges and risks may arise along the way, we are confident in the resilience of the market and its ability to deliver sustainable long-term returns. As we look ahead, we encourage investors to stay focused on their investment goals, remain disciplined in their approach, and seize the potential for growth and prosperity in the markets.

Shayne Heffernan