The Dollar is being dumped by Countries at an alarming rate, next no one will want to buy US Debt. It is time to be buying Bitcoin, FBX, Gold, Real Estate and Some Stocks.

As the US dollar collapses, it will have far-reaching consequences for the global economy. The US dollar was the world’s dominant reserve currency, meaning that it was held in large quantities by central banks and governments around the world. It was also the currency in which most international transactions are denominated, but all that is changing.

The collapse of the US dollar could cause a financial crisis for the USA. It could lead to a rapid devaluation of the currency, which would cause inflation to skyrocket. This, in turn, would make imports much more expensive, causing the cost of living to rise for everyone.

The collapse of the US dollar will also cause the value of US Treasury bonds and bills to plummet, as investors lose confidence in the ability of the US government to repay its debts. This would lead to a sharp rise in interest rates, which would make it much more expensive for the US government and businesses to borrow money.

In addition, the collapse of the US dollar is a major shift in global power dynamics. It has weakened the US’s position as a global superpower, the US no longer have the same economic influence that it use to enjoy.

Debt Crisis

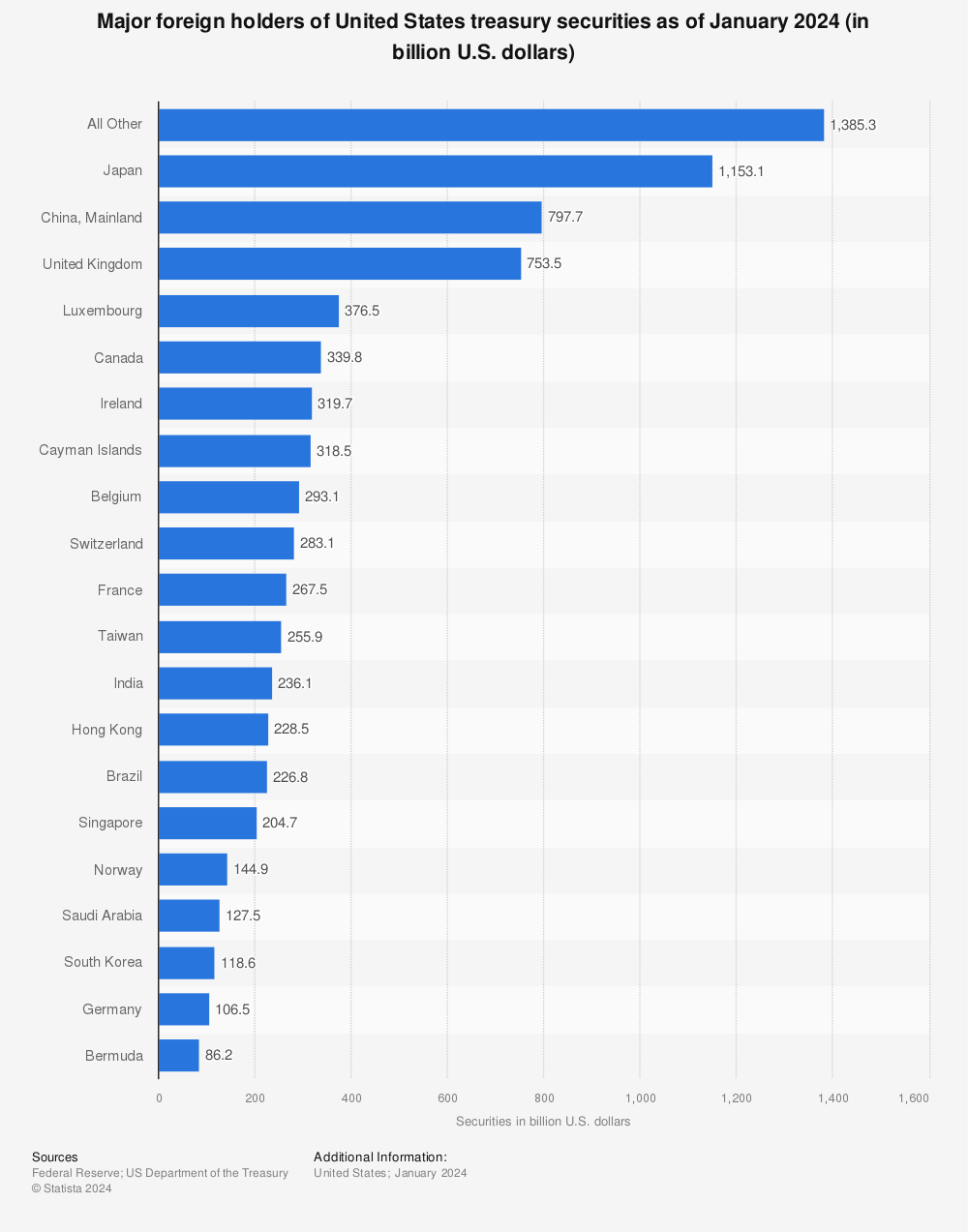

US government debt, in the form of Treasury bonds and bills, is an important source of funding for the US government. When the government needs to borrow money, it issues Treasury bonds and bills, which investors can buy. In exchange, the government promises to pay interest on the debt and to repay the principal at a later date.

source: tradingeconomics.com

If no one wants to buy US debt, it would be a significant problem for the US government. This is because the government relies on debt to finance its spending, and if it cannot borrow money, it would have to rely on other sources of funding, such as raising taxes or cutting spending. These options would likely be unpopular with the public, and will also have negative effects on the economy.

If investors were to stop buying US debt, it would likely lead to a decrease in demand for US dollars, which could cause the value of the dollar to fall. This could, in turn, lead to higher inflation, as the cost of imports would increase.

However, it is important to note that the likelihood of no one wanting to buy US debt is very low. US Treasury bonds are considered a safe investment because the US government has a strong track record of repaying its debt. Additionally, many foreign governments and central banks hold US debt as a reserve asset, and would likely continue to do so even if demand from private investors were to decrease.

Find more statistics at Statista

Investing During High Inflation

During times of high inflation, some assets tend to perform better than others. Here are some examples of assets that have historically performed well during periods of high inflation:

- Real estate: Real estate tends to be a good hedge against inflation, as the value of property tends to rise along with prices.

- Commodities: Commodities such as gold, silver, oil, and other natural resources tend to perform well during inflationary periods, as their prices tend to rise along with inflation.

- Stocks: Stocks of companies that can pass on higher costs to customers tend to perform well during inflationary periods. This includes companies in industries such as energy, materials, and healthcare.

- Inflation-protected bonds: Inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS), are designed to protect against inflation by adjusting their value for changes in the consumer price index.

- Cryptocurrencies: Some investors see cryptocurrencies such as Bitcoin as a potential hedge against inflation, as their value is not tied to any government or central bank.

It’s important to note that the performance of these assets can be affected by many factors beyond inflation, such as global economic conditions and political events. Additionally, investing always carries risks, and it’s important to consider your individual financial situation and goals before making any investment decisions.