Many traditional investors “HODL” their assets for a long period of time, even though the stock market is almost always less volatile than crypto. Investors who buy and hold benefit from long-term price appreciation.

No one knows who was the first one to say it. The original misspelling took place in a post by the user “GameKyuubi” on the Bitcointalk.org online forum, at 10:03 a.m. UTC on Dec. 18, 2013. He claimed he misspelled HOLD and decided to keep the error:

https://bitcointalk.org/index.php?topic=375643.0

Hodling is, simply put, Hold On for Dear Life

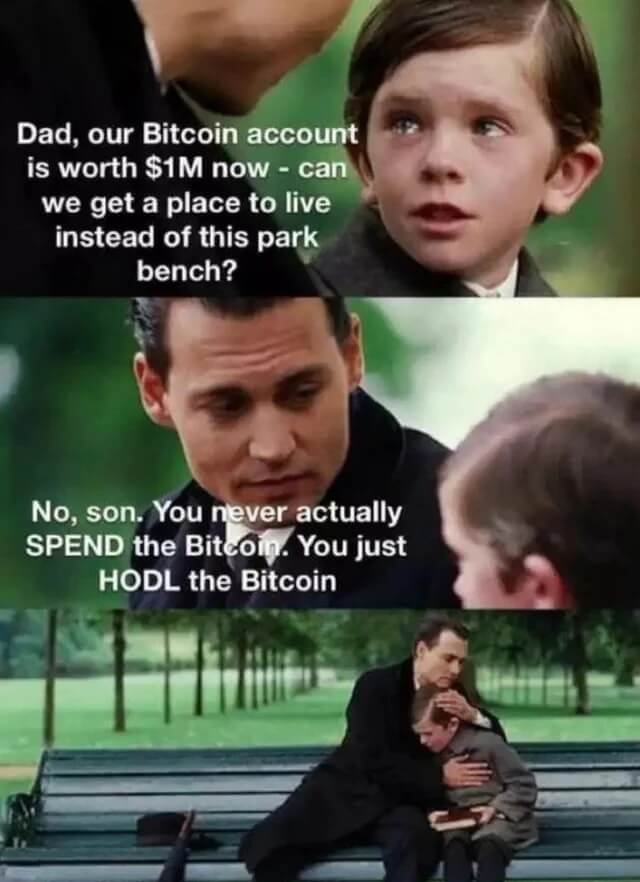

This usually refers to someone that will not sell their cryptocurrency no matter what. Hodling is for long term gain, and while past performance is no indication of future profit, and hodling is no guarantee of any profit at all, it is generally believed that as the market matures, the value of cryptocurrencies will increase.

This particularly concerns deflationary digital money such as Bitcoin and Islamic Coin.

We recommended that an investment into Crypto is not more than you can afford to lose and should only form part of your investment holdings.

Of course, traditional investors opt for more conservative terms such as dollar cost averaging, as a way to mitigate bitcoin’s short-term volatility. Whatever the case, with traditional investors coming fast into the fold, terminology will evolve with the times, fusing together the best of both worlds.

HODL has given rise to some wild memes, here are some of our favorites.