#profits #Fibonacci #uptrend #downtrend

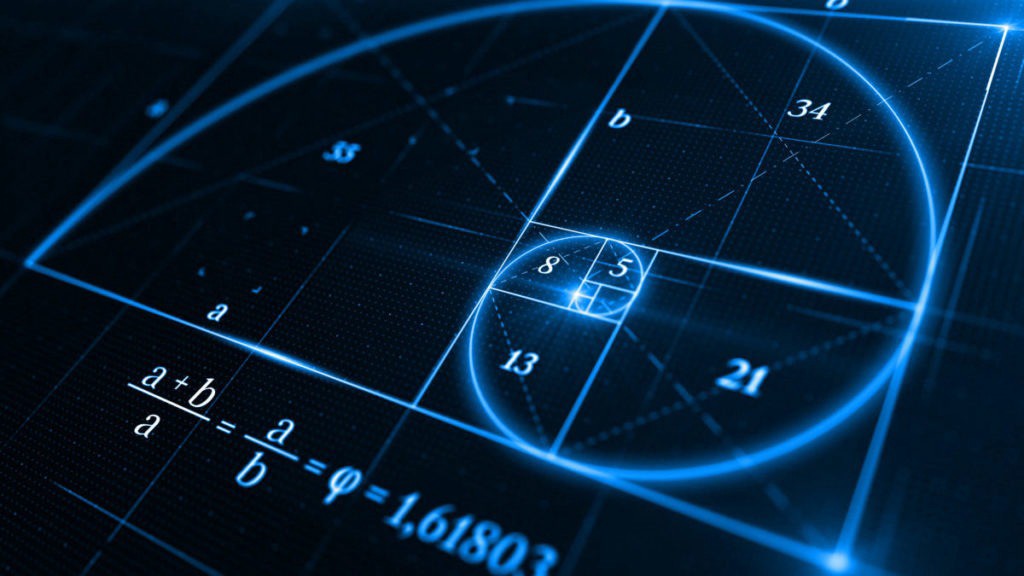

“Fibonacci numbers can tell traders and investors when to take profits” — Paul Ebeling

- Fibonacci retracement marks connect any 2 points that the trader views as relevant, typically a high point and a low point.

- The percentage levels provided are areas where the price could stall or reverse.

- The most commonly used ratios include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

- These marks should not be relied on exclusively, as it is dangerous to assume the price will reverse after hitting a specific Fibonacci mark.

The Big Q: How long should you hold?

The Big A: There a specific rule to help boost long-term stock investing success it is this: Once your stock has broken out, take most of your profits when they reach 25% and ride with the rest till the trend reverses. For traders the mark is 20-25%

In an up trend: The general idea is to take profits on a long trade at a Fibonacci Price Extension Level.

You determine the Fibonacci extension levels by using 3 mouse clicks.

1st, click on a significant Swing Low, then drag your cursor and click on the most recent Swing High. Finally, drag your cursor back down and click on any of the retracement levels.

This will display each of the Price Extension Levels showing both the ratio and corresponding price levels.

Let us look at the USD/CHF chart below.

The 50.0% Fib level held strongly as support and, after 3 tests, the pair finally resumed its uptrend.

In the chart above, you can even see the price rise above the previous Swing High.

Let us pop on the Fibonacci extension tool to see where would have been a good place to book some profits.

Below a recap of what happened after the retracement Swing Low occurred:

- Price rallied all the way to the 61.8% mark, which lined up closely with the previous Swing High.

- It fell back to the 38.2% mark, where it found support

- Price then rallied and found resistance at the 100% mark.

- A couple of days later, the price rallied yet again before finding resistance at the 161.8% mark.

As you can see from the example, the 61.8%, 100%, and 161.8% levels all would have been good places to book some profits.

Now, let us take a look at an example of using Fibonacci extension marks in a downtrend.

In a downtrend, the general idea is to take profits on a short trade at a Fibonacci extension level since the market often finds support at these marks.

Let us take another look at the downtrend on the 1-hour EUR/USD chart.

Here, we saw a Doji form just under the 61.8% Fibo mark. Price then reversed as sellers jumped back in, and brought price all the way back down to the Swing Low.

Let us now put up that Fibo Extension tool to see where would have been some good places to take profits had we shorted at the 61.8% retracement mark.

Here’s what happened after the price reversed from the Fibonacci retracement mark:

- Price found support at the 38.2% mark

- The 50.0% mark held as initial support, then became an area of interest

- The 61.8% mark became an area of interest, before price shot down to test the previous Swing Low

- Looking ahead, you learned that the 100% extension mark also acted as support

We could have taken off profits at the 38.2%, 50.0%, or 61.8% mark. All these marks acted as support, because other traders kept their eye on these marks for profit-taking as well.

There are problems to deal with so you must use your intuition in using the Fibonacci extension tool. You will have to judge how much longer the trend will continue.

Have a healthy day, Keep the Faith!