On Tuesday 7th February 2023, Bed Bath & Beyond Inc said that they raised around $225 million in a stock offering and may raise an additional $800 million over the next ten months as the struggling retailer attempts to avoid bankruptcy.

Two individuals familiar with the situation told Reuters on Tuesday, before the offering closed, that Hudson Bay Capital Management is the principal investor in the share sale.

Bed Bath & Beyond, which initially mentioned bankruptcy earlier this month, announced on Monday that it wanted to raise around $1 billion in a convoluted arrangement in which it offered preferred shares and warrants.

On the other hand, analysts believe the fresh funds may only last a few quarters, and a deteriorating economy will reduce the likelihood of a successful recovery.

The offering “may be a Band-Aid but I’m not certain of all the makeup of their balance sheet,” said Robert Gilliland, managing director at Concenture Wealth Management. “The problem is that they’re probably not going to be a big turnaround story.”

Bed Bath refused to comment on Hudson Bay Capital’s involvement in the stock sale. A request for response from Hudson Bay was not returned. Moreover, the Hudson Bay Capital project was initially reported by Bloomberg News.

Hudson Bay Capital is unrelated to Canadian department store chain Hudson’s Bay Co.

Bed Bath Chief Executive Sue Gove attempted to allay concerns in a letter to suppliers viewed by Reuters, saying she anticipated the stock sale to “catalyze our efforts to recover the firm.” She requested vendor assistance and pledged a “open dialogue.”

“We also expect it to enable strategic initiatives in fiscal 2023, providing the resources and the needed runway” to continue to execute its transformation, she said.

Two suppliers earlier told Reuters that Bed Bath’s vendors are concerned and have spoken little with the firm, which has been delaying or suspending payments.

“All is on hold,” a children’s clothing manufacturer said last week, adding that it has ceased shipping items to Bed Bath & Beyond since early January. Payments were “massively delayed,” according to a manufacturer of personal care items.

Bed Bath and Beyond did not reply quickly to a request for comment on the message or what vendors stated.

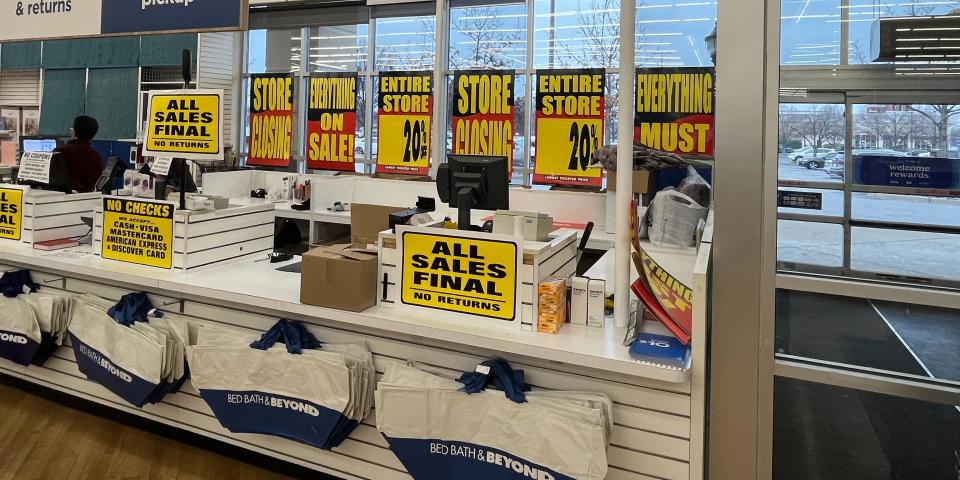

According to Reuters, Bed Bath and Beyond has lined up liquidators to liquidate other locations unless a last-minute buyer appeared.

Prices for Bed Bath & Beyond bonds due in 2024 rose to 24 cents on the dollar on Tuesday, up from around 5 cents the day before, but they still suggest financial concern.

MEME STOCK

Bed Bath & Beyond shares increased 3% in extended trading on Tuesday, after closing down 49% the day before.

“It just looks like a way of extending time in the hopes someone rescues them but that looks a bit unlikely,” said Chris Beauchamp, chief market analyst at IG. “Having been on the edge of the meme stock frenzy, it’s not surprising that this news has poked the embers of that particular mania.”

A part of the meme stock phenomenon, Bed Bath saw its shares surge as high as $30 last year, when activist investor Ryan Cohen took a stake in the company and pushed for changes.

AMC Entertainment and video game retailer GameStop Corp, which ended down 9% and 11% on Tuesday, are two other meme companies that have been blown up by retail investors in recent years.

“The popularity of meme stocks could ebb and flow depending on the market’s mood (but investors) just have to be careful about it, especially in a high-rate environment,” said Callie Cox, U.S. investment analyst at eToro.

Bed Bath and Beyond stated in a regulatory filing that previous volatility and current pricing “reflect market and trading factors unrelated to our core business, or macro or industry fundamentals, and we do not know if or how long these dynamics will persist.”

Source: Reuters

To speak to a professional in Cryptocurrency, contact KXCO.IO.

More News

Why FBX is Asia’s Must Own Cryptocurrency

KXCO $FBX a Dual-Finalist at Tech Investment Show in Thailand